What Is A Reverse Mortgage?

Consider a reverse mortgage as an ordinary mortgage in which the responsibilities are reversed.

With a traditional mortgage, a borrower obtains a loan to purchase a property, which they then pay back to the lender over time.

With a reverse mortgage, the homeowner borrows against their already-owned house to obtain a loan from a lender that they might not ever be able to pay back.

The borrower does not repay the majority of reverse mortgage loans. Rather, the property is sold by the borrower’s heirs to repay the loan in the event of the borrower’s death or relocation. Any extra revenues from the sale go to the borrower (or their estate).

The majority of reverse mortgages are provided by government-insured schemes with stringent guidelines and requirements for lending. Private reverse mortgages, also known as proprietary mortgages, are provided by non-bank private lenders; nevertheless, they are subject to less regulation and are more likely to be fraudulent schemes.

Are You Looking for a Mortgage?

How Does A Reverse Mortgage Work?

Using a reverse mortgage is a really easy process: The borrower who already owns a home is the first in line. Either the borrower has paid off the loan in full or they have significant equity in their home, typically equal to at least 50% of its market value. After determining that they require the liquidity that comes with taking out equity from their house, the borrower works with a reverse mortgage counselor to choose an appropriate reverse mortgage lender and program.

The borrower applies for the loan after selecting a certain loan package. In addition to reviewing the borrower’s property, title, and estimated value, the lender runs a credit check. If the loan is granted, the lender funds it. Depending on the borrower’s preference, the proceeds may be structured as a lump amount, a line of credit, or recurring annuity payments (monthly, quarterly, or annually, for example).

Rev- mortgage borrowers use the cash according to the terms of their loan agreement once a lender funds the loan. Certain loans are unrestricted, while others have limitations on how the money can be used (such for renovations or enhancements). These loans are repaid by the borrower (or their heirs) or the lender through the sale of the borrower’s property if the borrower passes away or relocates. Any money left over after the loan is repaid goes to the borrower.

Qualifications for Reverse Mortgages

The newest mortgagee of a property must be at least 62 years old to be eligible for a government-sponsored reverse mortgage. Only one primary lien may be obtained by borrowers against their principal residence; in other words, they are not permitted to have a second lien from a second mortgage or a home equity line (HELOC). Additionally, borrowers must either own their property outright or have significant equity in it, typically at least 50%. The money from a rev-mortgage must typically be used to pay off the borrower’s current mortgage if they do not own their home outright.

Generally speaking, government-backed reverse mortgages are only available for specific kinds of homes. Qualifiable attributes consist of:

- single-family residences

- Townhomes or condominiums

- properties with multiple units, up to four units

- constructed manufactured homes after June 15, 1976

Borrowers who are interested in government-sponsored reverse mortgages must also attend an informational session with a reverse mortgage counselor who has been approved. They must also maintain their property in good condition and pay their homeowner’s insurance and property taxes on time.

Related: Current Mortgage Refinance Rates July 2024

Limits on Reverse Mortgage Borrowing

You can borrow as much as you like with a proprietary mortgage; there are no upper limitations. Each lender has their own restrictions and limitations.

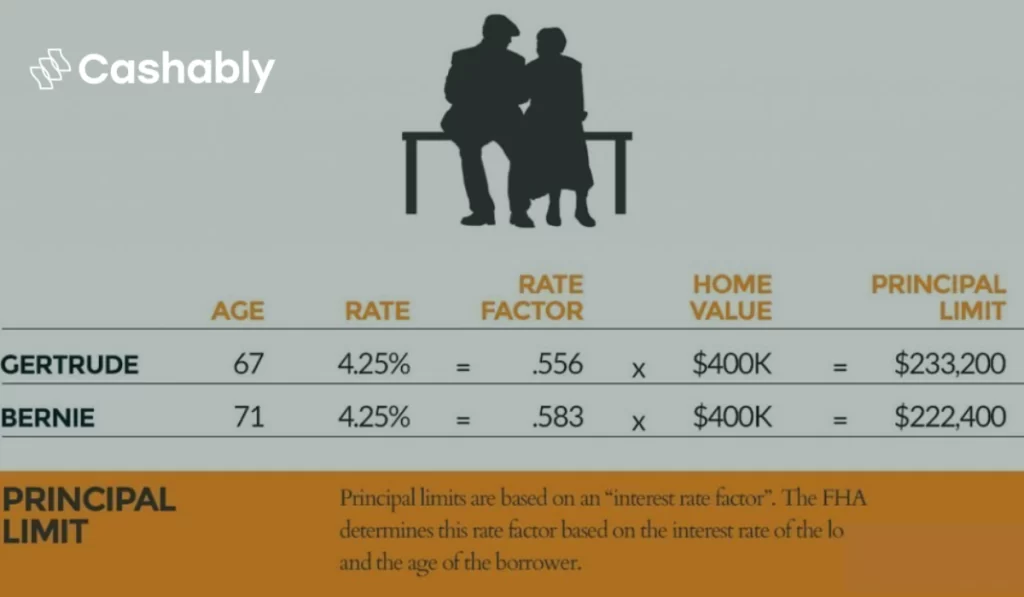

Nevertheless, homeowners are not allowed to borrow up to the appraised value of their property or the $765,600 FHA maximum claim amount while utilizing a government-backed reverse mortgage program. Borrowers can only obtain a loan equal to a percentage of the value of their property. Lenders often require a buffer in case property values decrease, and part of the property’s worth is utilized to collateralize loan expenses. The borrower’s age, credit history, and the interest rate of the loan all affect the borrowing limitations.