Consider a reverse mortgage to be a standard mortgage in reverse.

In a traditional mortgage, a borrower takes out a loan to buy a home and then repays the lender over time.

In a reverse mortgage, the homeowner already owns the home and borrows against it, receiving a loan from a lender that they may never repay.

Most reverse mortgage loans are not repaid by the borrower. Instead, when the borrower moves or dies, the heirs sell the property to repay the loan. The borrower (or their estate) receives any extra revenues from the sale.

Are You Looking For a Mortgage?

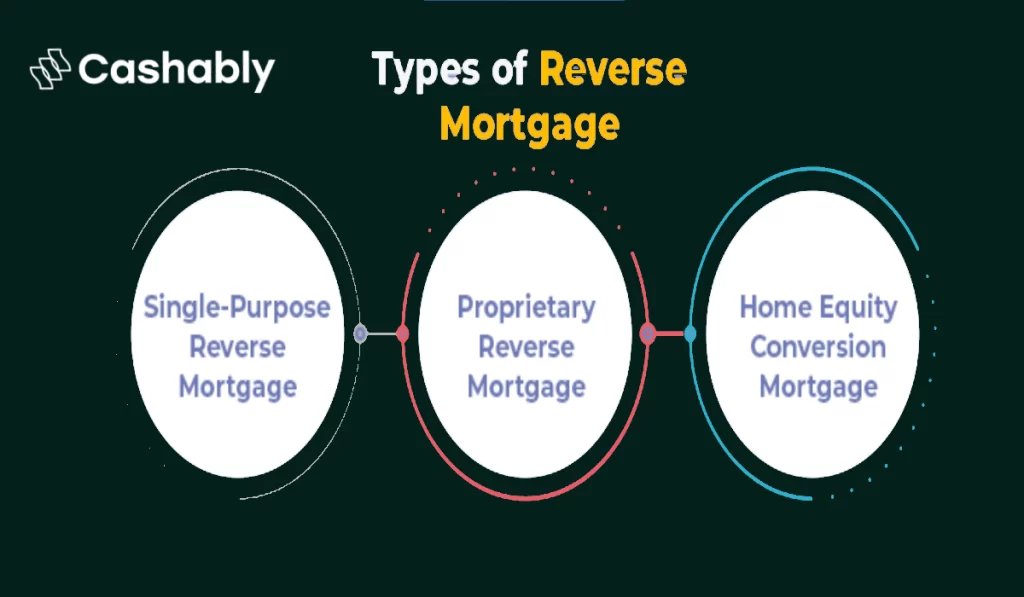

Types of Reverse Mortgages

Most reverse mortgages are government-insured. These products, like other government loans, such as USDA or FHA loans, contain requirements that normal mortgages do not have since they are government guaranteed. These include eligibility requirements, underwriting processes, funding choices, and, in some cases, restrictions on how funds are used. Private rev- mortgages have less stringent eligibility restrictions and financing standards.

Single-Purpose Reverse Mortgage

Single-purpose loans are usually the most inexpensive sort of rev- mortgage. These loans are made by charities and state and local governments for specific purposes specified by the lender. Loans may be offered for purposes like as repairs or renovations. However, loans are only available in specific places.

Home Equity Conversion Mortgages

Home equity conversion mortgages (HECMs) are HUD-backed and can be more expensive than standard mortgages. However, loan monies can be utilized for almost any purpose. Borrowers have various options for receiving their money, including a lump sum, fixed monthly payments, a line of credit, or a mix of regular payments and a line of credit.

Proprietary Reverse Mortgage

Proprietary reverse mortgages are private loans that are not guaranteed by a government body. Lenders determine their own qualifying criteria, rates, fees, terms, and underwriting procedures. While these loans are the easiest to obtain and fund, they are also known to attract unscrupulous professionals who utilize rev- mortgages to defraud naive seniors of their property’s equity.

Related: What is A Reverse Mortgage? Its Working and Advantages

Who should get a Reverse Mortgage?

Due to its structure, reverse mortgages are only suitable for specific types of borrowers. It may be wise to use rev- mortgages for:

- Seniors who are facing major expenses in their latter years

- Individuals who have used up all of their money and have a large amount of equity in their principal homes

- Individuals without heirs who might like to inherit their house

Who Must Stay Away from Reverse Mortgages?

Reverse mortgages can be useful in certain situations, but there are many reasons not to use them. Reverse mortgages are not a wise choice if:

- You are unable to locate a reliable lending program or lender.

- You can use your life insurance or other funds to pay for bills.

- You have family members who reside with you and must remain in the property beyond the reverse mortgage period, or you have heirs who wish to inherit your property.

How and When a Reverse Mortgage Is Repaid

The majority of reverse mortgage borrowers never plan to pay them back in full. In fact, you could be better off staying away from rev- mortgages entirely if you believe you may be able to repay the debt in full.

Rev- mortgages, however, typically need to be paid back when the borrower passes away, relocates, or sells their house. Then, the borrowers (or their heirs) have two options: they can sell the house and use the revenues to pay back the debt, with the sellers keeping any remaining funds after the loan is paid off.

A mortgage may require you to sell your house or make cash payments if:

- To aid with your care, you must relocate into an assisted living facility or live with a family member.

- You have the funds to repay the loan, and your living family members wish to keep your possessions (for instance, by taking out a loan against your life insurance policy or letting your heirs utilize the death benefit to pay down the loan).

One Response