Learn about home loans, their features, and benefits. Discover key details to make informed decisions when financing your new home.

What is a Home Loan?

A home loan, or a mortgage, is money borrowed from a bank or a financial institution to buy a house. Think of it as getting a loan from a friend to buy something expensive and then paying your friend back over time. Home loans help people buy homes without paying the entire cost upfront.

- Est. APR = 9.95% - 14%

- Loan Amount = $150,000 - $3,000,000

- Minimum FICO Score: N/A

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- 24/7 Support

- Bridge & Rental Loans

- Equal Housing Opportunity

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Check Your Eligibility

- Equal Housing Opportunity

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Why Do People Need Home Loans?

Buying a home is very expensive. Most people need more money to pay for a house at a time. Home loans allow people to spread out the cost of the house over many years. This makes it easier for families to own a home without waiting many years to save enough money.

Related: Current Interest Rate for Home Loans

Features of Home Loans

Many essential features of home loans help people understand how they work. Here are some of the key features:

Loan Amount

The loan amount is the total money borrowed from the bank. This amount depends on the price of the house and how much the borrower can afford to pay back. Banks usually lend up to 80-90% of the house’s value, and the borrower must pay the rest as a down payment.

Interest Rate

The interest rate is the extra money you must pay back on top of the loan amount. It’s like a fee for borrowing the money. Interest rates can be fixed or adjustable:

- Fixed Interest Rate: This rate stays the same throughout the loan period, making it easier to plan your monthly payments.

- Adjustable Interest Rate: This rate can change over time. It might start low but can increase or decrease depending on the market.

Loan Tenure

Loan tenure is the length of time you have to repay the loan. Home loan tenures can range from 10 to 30 years. A longer tenure means smaller monthly payments, but you’ll pay more interest over time. A shorter tenure means higher monthly payments but less interest overall.

Down Payment

The down payment is the initial money you pay when buying the house. It is usually a percentage of the total house price. For example, if the home costs $100,000 and the down payment is 20%, you need to pay $20,000 upfront, and the rest ($80,000) can be borrowed as a home loan.

Monthly Payments

Monthly payments, or EMIs (Equated Monthly Installments), are the amount you pay the bank monthly. These payments include a portion of the loan amount and the interest. Monthly payments are spread out over the loan tenure.

Collateral

Collateral is something valuable that the bank can take if you don’t repay the loan. In the case of home loans, the house itself is the collateral. If you fail to make payments, the bank can take the house and sell it to recover the money.

Prepayment and Foreclosure

Prepayment is when you pay extra money to reduce your loan amount. Some banks allow prepayments without any additional charges, while others might charge a fee. Foreclosure is when you repay the entire loan amount before the end of the tenure. It can help you save on interest, but some banks may have penalties for foreclosing early.

Eligibility Criteria

Banks have certain conditions that borrowers must meet to get a home loan. These criteria include age, income, employment status, and credit score. A good credit score and stable income increase your chances of getting a home loan.

Related: Best Home Loan Provider 2024

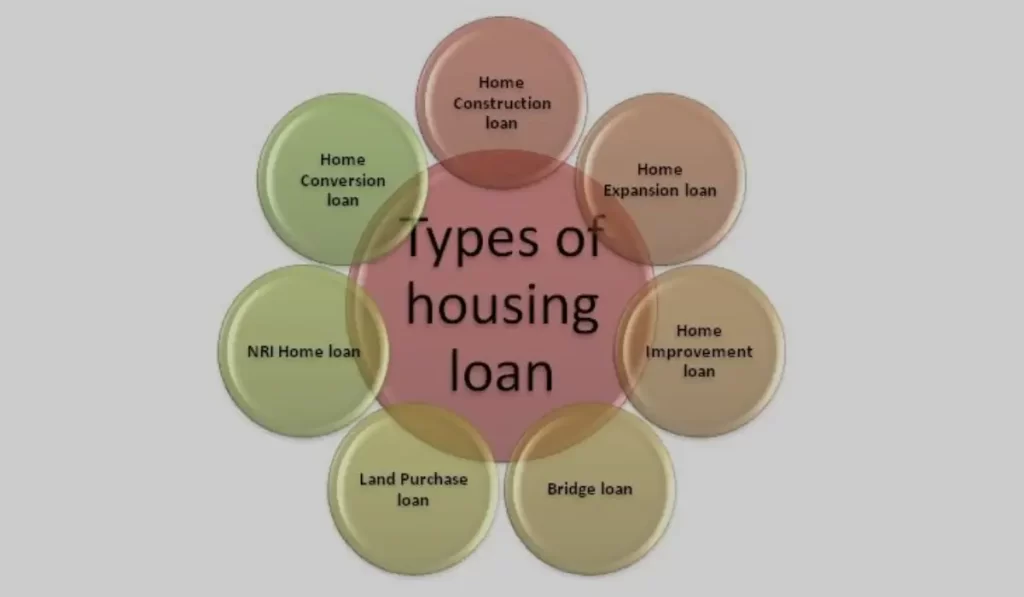

Types of Home Loans

There are different types of home loans to suit various needs. Here are some common ones:

Fixed-Rate Home Loan

As mentioned earlier, a fixed-rate home loan has an interest rate that doesn’t change during the loan tenure. It provides stability and makes it easier to plan your finances since your monthly payments remain the same.

Adjustable-Rate Home Loan

This type of loan has an interest rate that can change periodically. It usually starts with a lower rate than fixed-rate loans but can increase or decrease over time based on market conditions. It can be risky if rates rise significantly.

FHA Loan

FHA (Federal Housing Administration) loans are government-backed loans that help people with lower credit scores or smaller down payments buy a home. They have more lenient eligibility requirements but may require mortgage insurance.

VA Loan

VA (Veterans Affairs) loans are for military veterans and their families. These loans often don’t require a down payment and have competitive interest rates, which is an excellent benefit for those who have served in the military.

USDA Loan

USDA (United States Department of Agriculture) loans are for people buying homes in rural areas. They offer low interest rates and don’t require a down payment, making homeownership more accessible.

Jumbo Loan

Jumbo loans are for expensive homes that exceed the limits set by government-backed programs. Because they involve more significant loan amounts, they have stricter eligibility requirements and higher interest rates.

- Est. APR = 9.95% - 14%

- Loan Amount = $150,000 - $3,000,000

- Minimum FICO Score: N/A

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- 24/7 Support

- Bridge & Rental Loans

- Equal Housing Opportunity

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Check Your Eligibility

- Equal Housing Opportunity

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Steps to Get a Home Loan

Getting a home loan involves several steps. Here’s a simplified process:

- Determine Your Budget

Before applying for a loan, determine your affordability. Consider your income, expenses, and savings. Use online calculators to estimate your monthly payments and borrowing limit.

- Check Your Credit Score

A good credit score increases your chances of a loan with a favourable interest rate. Check your credit score and, if needed, take steps to improve it by paying off debts and making timely payments.

- Get Pre-Approved

Provide your financial information to a bank to get pre-approved for a loan. Pre-approval gives you an idea of how much you can borrow and shows sellers that you’re serious about buying a home.

- Choose the Right Loan

Compare different loan options and choose the one that best fits your needs. Consider factors like interest rates, loan tenure, and eligibility criteria.

- Complete the Application

Fill out the loan application form and provide the required documents, such as proof of income, tax returns, and identification. The bank will review your application and verify your information.

- Loan Approval and Disbursement

Once the bank approves your loan, they will provide a loan offer. Review the terms and conditions carefully. If everything looks good, accept the offer, and the bank will disburse the loan amount.

- Close the Deal

The final step is closing the deal, where you sign the loan agreement and other legal documents. After this, the bank transfers the loan amount to the seller, and you become the house owner.

Benefits of Home Loans

Home loans offer several benefits that make buying a home easier:

- Homeownership

Home loans allow people to own a home without saving the entire purchase price. Owning a home provides stability and a sense of accomplishment.

- Building Equity

When you make your monthly payments, you build equity in your home. Equity is the portion of the house you own outright, and your equity increases as you pay off your loan.

- Tax Benefits

Home loan borrowers can enjoy tax benefits on the interest paid. This can reduce the overall cost of borrowing and provide savings.

- Forced Savings

Paying your monthly mortgage is like a forced savings plan. It helps you build wealth over time as you pay down your loan and increase your equity in the home.

- Pride of Ownership

Owning a home gives you pride and freedom to customize and decorate it as you like. It provides a stable family environment and a place to create lasting memories.

Home loans are an essential financial tool that helps people achieve their dream of homeownership. By understanding their features, such as loan amounts, interest rates, and repayment terms, you can make informed decisions about borrowing money to buy a home. Consider different home loan types and choose the one that best suits your needs. With careful planning and responsible borrowing, a home loan can be a valuable step towards securing a place to call your own.

- Est. APR = 9.95% - 14%

- Loan Amount = $150,000 - $3,000,000

- Minimum FICO Score: N/A

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- 24/7 Support

- Bridge & Rental Loans

- Equal Housing Opportunity

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Check Your Eligibility

- Equal Housing Opportunity

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Read More

Read More

One Response