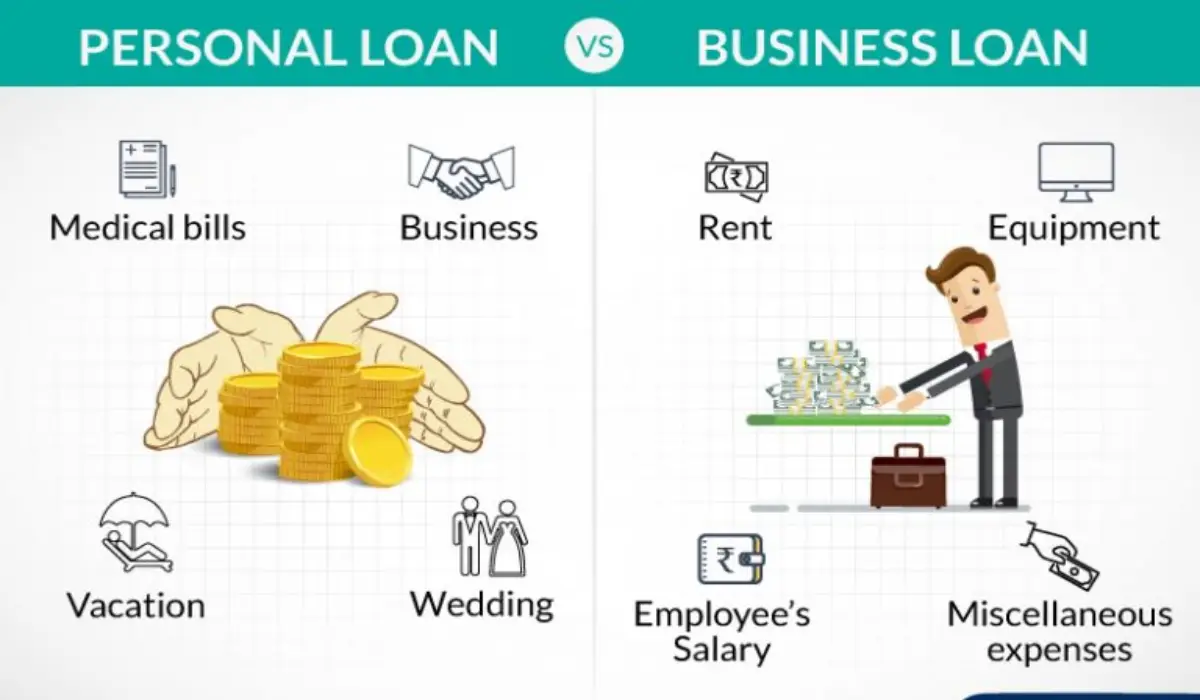

Personal and business loans are financial tools that help people and companies borrow money when needed. A personal loan is usually for individual needs like buying a car, paying for medical expenses, or handling emergencies. On the other hand, a business loan is for business-related expenses like starting a company, expanding it, or purchasing equipment.

Differences Between Personal and Business Loans

Personal Loans

A personal loan is money from a bank, credit union, or other lender. You pay it back over time with interest. People usually take personal loans for personal expenses such as home renovations, weddings, or debt consolidation.

Business Loans

Companies or entrepreneurs take business loans to cover their business needs. These personal and business loans help businesses grow, buy inventory, or handle daily expenses. The terms for business loans are often different from personal loans, with more significant amounts and specific requirements.

Best personal loan

- Est. APR = 6.99%

- Loan type : Personal

- Loan amount: $1k - $50k

- Min credit score: 580

4.3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 6.99-35.99%

- Loan Amount = $100-$40K

- Min Credit Score = 300

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 9.99 - 39.99%

- Loan Amount = $1k - $50k

- Min Credit Score = 580

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Personal Loan for No Credit

- Est. APR 7.80% - 35.99%

- Loan amount $1k– $50k

- Min credit score 300

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99% to 35.99%

- Loan amount $500 to $5,000

- Min credit score = Any

3.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99%-35.99%

- Loan amount $1Kto $35K

- Min credit score = 580

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Flexible loan amounts

- 24/7 Support

- No prepayment fees

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Related: Leading Personal Loan Providers for Debt Consolidation

Why Do People Take Personal Loans?

Common Uses of Personal Loans

People take personal loans for many reasons:

- Debt Consolidation: Combine multiple debts into one.

- Home Improvements: Upgrade or fix your home.

- Medical Expenses: Cover unexpected health bills.

- Big Purchases: Buy a car, furniture, or other expensive items.

- Education: Pay for tuition or other education-related costs.

Types of Business Loans

There are different types of business loans that companies can use:

- Startup Loans: For new businesses needing initial capital.

- Equipment Loans: To purchase machines or technology.

- Working Capital Loans: To cover daily operational costs.

- Expansion Loans: For businesses looking to grow.

How Personal and Business Loans Work

Both personal and business loans are borrowed and then paid back with interest. The lender gives you money upfront, and you repay the amount over time. Depending on the loan agreement, the repayment plan can vary monthly to yearly.

Personal Loan Requirements

Credit Score for Personal Loans

A good credit score is essential for getting a personal loan. Lenders look at your score to decide if they can trust you to pay back the money. A higher score means a better chance of getting approved.

Documents Needed for Personal Loans

To apply for a personal loan, you usually need:

- Proof of income (like pay stubs)

- Proof of identity (like a driver’s license)

- Bank statements

Related:Business Credit Loans USA – Cashably

Business Loan Requirements

Credit Score for Business Loans

Businesses also need a strong credit score to get a loan. The lender checks the company’s credit history to determine reliability.

Documents Needed for Business Loans

For business loans, you might need:

- Business financial statements

- Tax returns

- A business plan (to show how you will use the loan)

Secured vs Unsecured Loans

What Are Secured Loans?

Secured loans require you to offer something valuable as collateral, like a house or a car. If you fail to repay the loan, the lender can take the collateral.

What Are Unsecured Loans?

Unsecured loans don’t need collateral but often have higher interest rates. The lender takes on more risk since there is no guarantee (like a house or car).

Pros and Cons of Personal and Business Loans

Pros and Cons of Personal Loans

Pros:

- Flexible use of funds

- Fixed monthly payments

- Lower interest rates than credit cards

Cons:

- It may require a good credit score

- Missed payments can hurt your credit score

Pros and Cons of Business Loans

Pros:

- Can help grow your business

- Can offer tax benefits

- More significant loan amounts are available

Cons:

- Strict approval process

- May require collateral

How to Choose Between a Personal and a Business Loan

A personal loan is better if you borrow money for personal reasons. However, if the loan is for your business, a business loan will offer better terms and higher amounts.

Factors That Affect Loan Approval

Several factors determine whether you’ll get approved for a loan, including:

- Credit Score: A high credit score increases your chances.

- Income: Lenders want to ensure you can pay back the loan.

- Collateral: Secured loans require you to offer assets as security.

Interest Rates for Personal and Business Loans

Personal loans usually have fixed interest rates, meaning you pay the same monthly amount. Business loans might have variable rates, which can change over time. It’s crucial to compare rates before choosing a loan. In short, personal and business loans have fixed and variable interest rates, respectively.

How to Apply for a Loan (Personal and Business Loans)

- Check Your Credit Score: Ensure your score is in good standing.

- Compare Lenders: Different lenders offer different terms.

- Gather Documents: Get your financial and identification documents ready.

- Submit Your Application: Fill out the lender’s application and await approval.

Choosing between personal and business loans depends on your needs. Personal and business loans are for individual expenses and company expenses, respectively. Always research and compare different loans before applying to get the best deal.

- Amount = $5,000 to $500,000

- Loan Term = 4 to 24 months

- Interest Rate = 1.11%

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Min. Amount = $10,000

- Max Amount = $500,000

- APR = Factor rate starting at 1.11%

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best for large business loans

- Loan Amount = $25,000 - $3,000,000

- $10,000 in Monthly Rev

- No minimum credit score requirement

4.9

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best for large business loans

- Min Amount = $5,000 - 1,500,000

- APR range Not disclosed

- Minimum Credit Score 570

4.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best for Small business loans

- Min Credit Score = 620

- Loan Amount = $10K-$5M

- Term = 6 months - 10 years

- APR = Variable

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Check Your Eligibility

- Get $10K to $2M

- 24/7 Support

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Amount = $10,000 to $1,000,000

- Factor Rate = Starting at 1.24

- Term = 2 to 12 months

4.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Loan Tenure: How Long Do You Have to Repay?

The loan tenure is the length of time over which you agree to repay the loan. For personal and business loans, loan tenure ranges from 1-7 or a few months to decades, respectively. Shorter loan tenures mean higher monthly payments but lower overall interest costs. In comparison, longer tenures spread out payments but can lead to paying more interest over time.

Fixed vs Variable Interest Rates

Loans can come with fixed or variable interest rates. Fixed interest rates stay the same throughout the life of the loan, meaning your payments won’t change. This provides stability and predictability, making it easier to plan your budget. On the other hand, variable interest rates can change over time. If interest rates go up, your payments could increase, but you may benefit from lower costs if they go down. Variable rates are often tied to market conditions, making them less predictable.

Can You Pay Off Personal and Business Loans Early?

Some loans offer the option to pay off the loan early, saving you money on interest. However, it’s essential to check if there are any early repayment penalties. Some lenders charge fees if you pay off the loan before the agreed end date, as they lose out on earning interest. If you’re considering early repayment, read the fine print in your loan agreement.

The Role of Interest in Loans

Interest is the cost of borrowing money and plays a significant role in personal and business loans. Lenders charge interest to make money from lending. The interest rate can vary based on several factors, including your credit score, loan amount, and the lender’s policies.

Simple vs Compound Interest

You may encounter simple or compound interest when you take out a loan. Simple interest is calculated only on the original loan amount. In contrast, compound interest is calculated on the original amount plus any interest already added. Compound interest can make your loan more expensive, especially for long-term loans.

Related: Women Business Loans: Promoting Female Entrepreneurs

What Additional Costs Should You Expect?

Aside from interest, several fees are associated with taking out a loan. These can include:

- Origination fees: Charged by the lender to process your loan.

- Late payment fees: Charged if you miss a payment.

- Prepayment penalties: Charged if you pay off the loan early.

Ask about all potential fees before committing to a loan, as they can add up quickly and impact the total cost of borrowing.

The Importance of Comparing Lenders

Not all lenders are the same, and their loan offerings can vary greatly. One lender offers better interest rates, while another offers more flexible repayment terms. It’s crucial to compare lenders before deciding on personal and business loans. Many online tools can help you compare interest rates, fees, and terms to find the loan that best suits your needs.

Alternative Loan Options for Personal and Business Loans

If traditional personal and business loans are not the right fit, alternative loan options are available. These include:

- Peer-to-peer (P2P) lending involves borrowing from individuals rather than banks. P2P platforms connect borrowers with investors willing to lend money, often at competitive rates.

- Crowdfunding: Particularly popular for businesses, crowdfunding allows you to raise money from many people, usually through an online platform. In exchange, lenders or investors might receive rewards or equity in the business.

- Microloans: These are smaller loans, typically offered by nonprofit organizations, that can help new or small businesses get started.

Personal and business loans have pros and cons, so it’s essential to research them thoroughly before choosing an alternative loan.

Securing a Loan with Bad Credit

A low credit score can make getting approved for a loan more difficult, but it’s not impossible. You can take several steps to improve your chances of securing personal and business loans, even with bad credit.

Ways to Get a Loan with Bad Credit

- Please apply for a secured loan: Secured loans are less risky for lenders because they have collateral backing them. If you need better credit, offering collateral such as a car or property can improve your chances of approval.

- Get a cosigner: A cosigner is someone with a good credit score who agrees to take responsibility for the loan if you fail to repay it. Having a cosigner can make you a more attractive borrower to lenders.

- Look for lenders who specialize in bad credit loans. Some lenders are willing to work with borrowers with lower credit scores. However, these loans often have higher interest rates to compensate for the added risk.

- Improve your credit score: Consider your score before applying for a loan. You can do this by paying off debt, making timely payments, and reducing overall credit utilization.

How to Avoid Loan Scams

Unfortunately, loan scams are common, primarily online. Scammers prey on people desperate for money, offering fake loans with promises of easy approval. To avoid loan scams, follow these tips:

- Check for a legitimate lender: Always verify that the lender is a reputable and registered financial institution. Look for reviews and check if they are registered with the relevant financial authorities.

- Be wary of upfront fees. Scammers often ask for a payment before processing the loan, which is a red flag. Legitimate lenders won’t require upfront payment.

- Read the fine print: Ensure you understand the loan terms before agreeing. If something seems too good to be true, it probably is.

- Avoid high-pressure tactics: Scammers may pressure you to decide quickly, but a legitimate lender will give you time to think it over and ask questions.

Refinancing might be a good option if you already have a loan but want better terms. Refinancing allows you to take out a new loan to pay off an existing one, usually at a lower interest rate or with more favorable repayment terms. This can help you save money in the long run or make your monthly payments more manageable.

When Should You Refinance?

You should consider refinancing if:

- Interest rates have dropped: Refinancing could save you money if interest rates are lower now than when you initially took out the loan.

- Your credit score has improved: A better credit score can help you qualify for a loan with better terms.

- You want to change your loan tenure: Refinancing can help you shorten or lengthen your loan term, depending on your current financial situation.

While refinancing can be beneficial, it’s not always the best choice for everyone. Be aware of the following risks:

- Fees and closing costs: Just like with the original loan, refinancing comes with its fees, which can sometimes outweigh the savings.

- Extending your loan term: If you extend the loan term, you could pay more interest over time, even if your monthly payments are lower.

- Impact on credit score: Applying for a new loan, including refinancing, can temporarily lower your credit score due to the hard credit inquiry.

Building Financial Literacy for Better Loan Management

Understanding how personal and business loans work is only one piece of the puzzle. To manage your finances effectively and avoid getting overwhelmed by debt, you must improve your financial literacy. This includes learning how to budget, understanding how interest works, and avoiding bad financial decisions.

Many resources, such as online courses, financial advisors, and books, are available to help you gain the knowledge you need. With a better understanding of your finances, you’ll be better prepared to take out loans responsibly and pay them off without stress.

FAQs for Personal and Business Loans

1. How Do I Improve My Credit Score for a Loan?

Paying off debts on time, keeping balances low, and avoiding opening new credit lines can improve your credit score.

2. Can I Use a Personal Loan for My Business?

Yes, you can use personal and business loans, but applying for a business loan might be better if you seek higher amounts and specific business terms.

3. What Are the Risks of Taking a Business Loan?

The most significant risks include being unable to repay the loan, which could lead to losing your collateral or damaging your credit score.

4. What Happens If I Miss a Loan Payment?

Missing a payment can result in late fees and damage your credit score. For secured loans, the lender may take your collateral.

5. How Much Can I Borrow?

The amount you can borrow depends on your credit score, income, and the type of loan you apply for.

Best personal loan

- Est. APR = 6.99%

- Loan type : Personal

- Loan amount: $1k - $50k

- Min credit score: 580

4.3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 6.99-35.99%

- Loan Amount = $100-$40K

- Min Credit Score = 300

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 9.99 - 39.99%

- Loan Amount = $1k - $50k

- Min Credit Score = 580

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Personal Loan for No Credit

- Est. APR 7.80% - 35.99%

- Loan amount $1k– $50k

- Min credit score 300

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99% to 35.99%

- Loan amount $500 to $5,000

- Min credit score = Any

3.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99%-35.99%

- Loan amount $1Kto $35K

- Min credit score = 580

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Flexible loan amounts

- 24/7 Support

- No prepayment fees

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Read More

Read More