What is a Business Term Loan?

A traditional term loan is a straightforward funding solution for small businesses. This upfront lump sum that comes with a fixed interest rate and a fixed repayment period, it’s a popular choice for many small business owners. Term loans are simple and you pay a fixed amount each month until the loan is paid back. With a fixed repayment schedule, a term loan is great for paying for specific expenses or investing in growth.

Term loans are flexible and can be used for many things. For example, business owners may use a traditional business term loan to grow their business, manage cash flow, for working capital, purchase equipment, or even buy real estate.

Types of Business Loans

Business loans come in various forms, each designed to cater to a business line own specific needs and circumstances. Understanding the different types of business loans can help small business owners make informed decisions about their financing options.

SBA Loan

An SBA loan is a type of business loan guaranteed by the Small Business Administration (SBA). These loans are designed to provide small businesses with access to capital at favorable terms, such as lower interest rates and longer repayment periods than traditional commercial lenders. SBA loans can be used for a variety of purposes, including purchasing equipment, expanding operations, and refinancing debt. The backing of the SBA often makes these loans more accessible to small businesses that might not qualify for traditional business loans.

Business Loans

01

Business Loans

02

Business Loans

03

Business Loans

04

Business Loans

05

Business Loans

06

5

Average Review

Bank

- Est APR = 4.70%

- NO overdraft fees, ever

- FREE ATM* use — nationwide

- Free in-person notary services, incoming wires, and check images

5

Average Review

Bank

- Est. APR = 1.5%+

- Max Amount = $75,000

- No Hidden Fees

- FDIC Insurance

5

Average Review

Bank

- Est APR = 11.79-20.84%

- Min Credit Score = 730

- Loan Amount = $7,000 - $50,000

Banks and Their Role in

Personal and Business Finance

Banks have long been at the center of financial systems, providing a range of services that are essential for both individuals and businesses. For a platform like Cashably, which connects users with trusted financial partners, understanding the role of banks is crucial. This article will explore the different types of banks, their services, how they help people manage money, and their relevance to Cashably users seeking financial solutions.

1. What is a Bank?

A bank is a financial institution licensed to accept deposits and make loans. Banks play a critical role in financial stability by providing customers with a safe place to store their money, access credit, and carry out financial transactions. They also act as intermediaries, pooling money from savers and lending it to individuals and businesses.

Banks differ in size, scope, and the types of services they offer. Cashably partners with various types of banks to provide users access to multiple financial options.

2. Types of Banks

There are several categories of banks, each serving different financial needs. Here’s a breakdown:

Commercial Banks: These are the most common type of bank, offering services like savings accounts, checking accounts, personal loans, and business loans. Commercial banks are central to everyday banking needs.

Investment Banks: Primarily focused on raising capital for businesses, investment banks handle mergers, acquisitions, and stock or bond offerings. They don’t usually offer personal banking services but are vital to large businesses and corporations.

Credit Unions: While not technically banks, credit unions operate similarly, offering savings accounts, loans, and other financial services. The key difference is that credit unions are member-owned and typically offer lower fees and higher interest rates on savings than commercial banks.

Online Banks: With the rise of digital banking, many institutions now operate exclusively online. Online banks usually offer competitive interest rates and lower fees because they don’t have the overhead of physical branches.

Central Banks: These banks regulate the supply of money and interest rates in a country. In the U.S., the Federal Reserve (Fed) is the central bank, and it also acts as a lender of last resort for commercial banks.

3. Services Banks Offer

Banks provide a wide variety of services tailored to personal and business needs. Here’s a closer look:

Personal Banking Services:

- Savings and Checking Accounts: These are the core services for individuals looking to manage their daily finances.

- Loans: Banks offer personal loans, auto loans, mortgages, and other credit options for large purchases.

- Credit Cards: Many banks offer credit cards that come with rewards and benefits.

- Online and Mobile Banking: With advancements in technology, almost all banks offer online and mobile banking options, allowing customers to manage their accounts, make payments, and transfer funds with ease.

Business Banking Services:

- Business Loans: Banks provide business loans for startups, expansions, or working capital.

- Merchant Services: Banks help businesses accept payments, manage payroll, and handle other financial transactions.

- Lines of Credit: Businesses often rely on credit lines for short-term financial needs, such as managing cash flow.

For Cashably users, banks represent a crucial partner in their journey to secure loans or manage existing debt through consolidation or refinancing options.

4. How Banks Help Individuals and Businesses

Banks serve a critical function in the financial lives of individuals and businesses by facilitating various financial processes:

Access to Credit: Whether you’re looking to buy a home, a car, or finance a business, banks are a go-to source for loans. They offer various credit options, from personal loans to large-scale commercial loans.

Savings and Investments: Banks provide savings accounts, certificates of deposit (CDs), and investment opportunities to help individuals grow their wealth over time. For businesses, investment accounts can help manage surplus funds or plan for future growth.

Debt Consolidation: One of the key benefits Cashably promotes is debt consolidation through financial institutions like banks. Instead of juggling multiple high-interest debts, users can consolidate them into one manageable loan, often at a lower interest rate.

Financial Guidance: Many banks offer financial advisory services to help individuals plan for retirement, save for education, or manage investments. Businesses also benefit from advisory services related to cash flow management, investments, and growth planning.

5. How Cashably Works with Banks

At Cashably, we connect users with banks and other financial partners who provide loan options tailored to their needs. Whether you’re looking for a personal loan, business financing, or credit repair, our network of participating banks offers a range of services.

Loan Matching: Cashably helps users find banks that match their specific financial needs. Our network includes commercial banks, credit unions, and online banks, giving users a wide range of options.

Credit Repair and Debt Relief: For individuals with less-than-perfect credit, Cashably works with banks that offer credit repair services or specialize in providing loans to people with lower credit scores. Debt relief services can help users manage or consolidate existing debt, potentially lowering their interest rates.

No Obligation: Users are not obligated to accept any offers made by our partner banks. Our platform simply provides access to various loan options, allowing users to shop around for the best fit.

6. What to Consider When Working with Banks

Before engaging with any financial institution, it’s important to evaluate the terms and services offered. Here are some factors to consider:

Interest Rates: Interest rates can vary significantly between banks and loan products. Always compare rates to find the most affordable option.

Fees: Banks may charge fees for various services, such as origination fees for loans or monthly maintenance fees for checking accounts. It’s important to understand these costs before committing to any financial product.

Reputation and Trustworthiness: Not all banks are the same. Look for banks with a good reputation, strong customer service, and clear terms. Cashably’s partners are carefully vetted to ensure they meet high standards.

Security and Privacy: Data security is critical when working with banks, especially online. Make sure the bank or financial institution you choose has strong security measures in place to protect your personal and financial information.

Banks are an integral part of the financial ecosystem, providing essential services that help individuals and businesses thrive. Whether you’re looking to save money, access credit, or manage debt, banks offer a variety of products designed to meet your needs.

At Cashably, we connect you with reputable banks that offer the financial solutions you’re looking for, from personal loans to credit repair. Explore your options, compare loan terms, and make informed decisions to secure a stable financial future. Remember, Cashably is here to simplify the process of finding the right bank for your unique situation, but the final decision is always yours.

Commercial Real Estate Loan

A commercial real estate loan is a type of business loan used to finance the purchase or renovation of commercial property. These loans are typically secured by the property itself and offer longer repayment periods than other types of business loans. Commercial real estate loans can be used to finance a variety of properties, including office buildings, retail spaces, and warehouses. This type of loan is ideal for businesses looking to expand their physical footprint or invest in property as part of their growth strategy.

Business Term Loan Benefits

A business term loan can offer the most significant advantages:

One off lump sum: A term loan gives you a lump sum upfront which is great for specific business needs.

Fixed Interest Rate: Most term loans have a fixed interest rate so you can budget each month without worrying about rate changes.

Cash Flow Management: By getting a large sum upfront businesses can manage cash flow especially during seasonal ups and downs.

Investment in Growth: Business term loans allow for big investments like purchasing equipment, expanding to new locations or acquiring property.

Advantages of Business Term Loans

Business term loans offer several advantages to small business owners, including:

Predictable Loan Payments: Business term loans come with fixed interest rates and repayment terms, making it easier for small business owners to budget for loan payments. This predictability helps in managing monthly expenses without any surprises.

Access to Capital: Business term loans provide small business owners with the capital they need to grow and expand their businesses. Whether it’s for purchasing new equipment, expanding operations, or refinancing existing debt, these loans offer the necessary financial boost.

Flexibility: Business term loans can be used for a variety of purposes, including purchasing equipment, expanding operations, and refinancing debt. This flexibility allows business owners to address specific financial needs as they arise.

Building Credit: Regular loan payments on a business term loan can help small business owners build their credit. A strong credit history can open doors to more favorable financing options in the future.

Disadvantages of Business Term Loans

While business term loans offer several significant advantages here, they also have some disadvantages, including:

Collateral Requirements:

Many business term loans require collateral, which can be a risk for small business owners if they are unable to repay the loan. This means that personal or business assets may be at stake.

Interest Rates:

Business term loans can have high interest rates, especially for those with lower credit scores. This can increase the overall cost of borrowing and impact the business’s profitability.

Repayment Terms:

Business term loans have fixed repayment terms, which can be inflexible for small business owners who may need to adjust their loan payments due to fluctuating cash flow. This rigidity can be challenging during periods of financial instability.

Fees:

Business term loans may come with fees, such as origination fees and late payment fees, which can increase the cost of borrowing. It’s important for business owners to review all associated costs before committing to a loan.

By understanding both the advantages and disadvantages of business term loans, small business owners can make more informed decisions about their financing options and choose the best solution for small business owner and their specific needs.

Business Loans

There are several types of small business loans used:

- Traditional Term Loans: Offered by banks and credit unions, traditional term loans have fixed interest rates and clear repayment terms. To secure a traditional business loan, lenders generally expect a minimum credit score of 600.

- SBA Loans: Backed by the Small Business Administration, SBA loans have better terms and lower interest rates but may require more paperwork and a longer approval process.

- Online Loans: Online lenders have a faster application process and can approve loans quicker than banks.

- Line of Credit: Unlike term loans a line of credit is a revolving credit facility. This means businesses can draw funds as needed and only pay interest on what they borrow.

Each type of loan has its uses. For example a more traditional bank term loan may be perfect for a one off expense, a line of credit may be better for ongoing cash flow needs.

Term Loan Costs and Regulations

It’s important alternative lenders to understand the costs and fees of a term loan:

Interest Rates: Interest rates vary depending on the lender and the borrower. Traditional banks may have lower rates, online lenders slightly higher due to faster approval.

Fees: Term loans may have fees such as origination fees, closing costs and possibly late payment fees. Make sure to review all fees to know the total cost of the loan.

Repayment Terms: Repayment terms for term loans are usually 1-5 years depending on the loan amount and lender.

Collateral Requirements: Some larger term loans may require collateral such as business equipment or property. Collateral secures the loan and reduces risk for the lender.

Business Loan Requirements

To qualify for a first business credit term loan lenders usually require:

- Credit Score: A minimum credit score of 600 is usually required, some lenders may have stricter criteria.

- Business Revenue: Many lenders require a minimum annual revenue of $250,000 to ensure the business can service the loan.

- Time in Business: Lenders may require a business to be in operation for at least 2 years.

- Collateral: For larger loan amounts some lenders may require collateral. This is especially true for larger loans.

When to use a Traditional Term Loan

Business term loans are for specific financial institutions and needs. Here are the scenarios where it’s a good fit:

A term loan can cover big expenses like purchasing equipment or acquiring property.

Businesses with fluctuating revenue can use a term loan to stabilize cash flow during slow periods.

Whether launching a new product or expanding an existing service a term loan provides a lump sum to cover initial costs.

Business owners can use a term loan to consolidate high interest debt and potentially reduce overall interest costs.

Business Loans

01

Business Loans

02

Business Loans

03

Business Loans

04

Business Loans

05

Business Loans

06

5

Average Review

Bank

- Est APR = 4.70%

- NO overdraft fees, ever

- FREE ATM* use — nationwide

- Free in-person notary services, incoming wires, and check images

5

Average Review

Bank

- Est. APR = 1.5%+

- Max Amount = $75,000

- No Hidden Fees

- FDIC Insurance

5

Average Review

Bank

- Est APR = 11.79-20.84%

- Min Credit Score = 730

- Loan Amount = $7,000 - $50,000

Banks and Their Role in

Personal and Business Finance

Banks have long been at the center of financial systems, providing a range of services that are essential for both individuals and businesses. For a platform like Cashably, which connects users with trusted financial partners, understanding the role of banks is crucial. This article will explore the different types of banks, their services, how they help people manage money, and their relevance to Cashably users seeking financial solutions.

1. What is a Bank?

A bank is a financial institution licensed to accept deposits and make loans. Banks play a critical role in financial stability by providing customers with a safe place to store their money, access credit, and carry out financial transactions. They also act as intermediaries, pooling money from savers and lending it to individuals and businesses.

Banks differ in size, scope, and the types of services they offer. Cashably partners with various types of banks to provide users access to multiple financial options.

2. Types of Banks

There are several categories of banks, each serving different financial needs. Here’s a breakdown:

Commercial Banks: These are the most common type of bank, offering services like savings accounts, checking accounts, personal loans, and business loans. Commercial banks are central to everyday banking needs.

Investment Banks: Primarily focused on raising capital for businesses, investment banks handle mergers, acquisitions, and stock or bond offerings. They don’t usually offer personal banking services but are vital to large businesses and corporations.

Credit Unions: While not technically banks, credit unions operate similarly, offering savings accounts, loans, and other financial services. The key difference is that credit unions are member-owned and typically offer lower fees and higher interest rates on savings than commercial banks.

Online Banks: With the rise of digital banking, many institutions now operate exclusively online. Online banks usually offer competitive interest rates and lower fees because they don’t have the overhead of physical branches.

Central Banks: These banks regulate the supply of money and interest rates in a country. In the U.S., the Federal Reserve (Fed) is the central bank, and it also acts as a lender of last resort for commercial banks.

3. Services Banks Offer

Banks provide a wide variety of services tailored to personal and business needs. Here’s a closer look:

Personal Banking Services:

- Savings and Checking Accounts: These are the core services for individuals looking to manage their daily finances.

- Loans: Banks offer personal loans, auto loans, mortgages, and other credit options for large purchases.

- Credit Cards: Many banks offer credit cards that come with rewards and benefits.

- Online and Mobile Banking: With advancements in technology, almost all banks offer online and mobile banking options, allowing customers to manage their accounts, make payments, and transfer funds with ease.

Business Banking Services:

- Business Loans: Banks provide business loans for startups, expansions, or working capital.

- Merchant Services: Banks help businesses accept payments, manage payroll, and handle other financial transactions.

- Lines of Credit: Businesses often rely on credit lines for short-term financial needs, such as managing cash flow.

For Cashably users, banks represent a crucial partner in their journey to secure loans or manage existing debt through consolidation or refinancing options.

4. How Banks Help Individuals and Businesses

Banks serve a critical function in the financial lives of individuals and businesses by facilitating various financial processes:

Access to Credit: Whether you’re looking to buy a home, a car, or finance a business, banks are a go-to source for loans. They offer various credit options, from personal loans to large-scale commercial loans.

Savings and Investments: Banks provide savings accounts, certificates of deposit (CDs), and investment opportunities to help individuals grow their wealth over time. For businesses, investment accounts can help manage surplus funds or plan for future growth.

Debt Consolidation: One of the key benefits Cashably promotes is debt consolidation through financial institutions like banks. Instead of juggling multiple high-interest debts, users can consolidate them into one manageable loan, often at a lower interest rate.

Financial Guidance: Many banks offer financial advisory services to help individuals plan for retirement, save for education, or manage investments. Businesses also benefit from advisory services related to cash flow management, investments, and growth planning.

5. How Cashably Works with Banks

At Cashably, we connect users with banks and other financial partners who provide loan options tailored to their needs. Whether you’re looking for a personal loan, business financing, or credit repair, our network of participating banks offers a range of services.

Loan Matching: Cashably helps users find banks that match their specific financial needs. Our network includes commercial banks, credit unions, and online banks, giving users a wide range of options.

Credit Repair and Debt Relief: For individuals with less-than-perfect credit, Cashably works with banks that offer credit repair services or specialize in providing loans to people with lower credit scores. Debt relief services can help users manage or consolidate existing debt, potentially lowering their interest rates.

No Obligation: Users are not obligated to accept any offers made by our partner banks. Our platform simply provides access to various loan options, allowing users to shop around for the best fit.

6. What to Consider When Working with Banks

Before engaging with any financial institution, it’s important to evaluate the terms and services offered. Here are some factors to consider:

Interest Rates: Interest rates can vary significantly between banks and loan products. Always compare rates to find the most affordable option.

Fees: Banks may charge fees for various services, such as origination fees for loans or monthly maintenance fees for checking accounts. It’s important to understand these costs before committing to any financial product.

Reputation and Trustworthiness: Not all banks are the same. Look for banks with a good reputation, strong customer service, and clear terms. Cashably’s partners are carefully vetted to ensure they meet high standards.

Security and Privacy: Data security is critical when working with banks, especially online. Make sure the bank or financial institution you choose has strong security measures in place to protect your personal and financial information.

Banks are an integral part of the financial ecosystem, providing essential services that help individuals and businesses thrive. Whether you’re looking to save money, access credit, or manage debt, banks offer a variety of products designed to meet your needs.

At Cashably, we connect you with reputable banks that offer the financial solutions you’re looking for, from personal loans to credit repair. Explore your options, compare loan terms, and make informed decisions to secure a stable financial future. Remember, Cashably is here to simplify the process of finding the right bank for your unique situation, but the final decision is always yours.

Apply for a Business Loan

- Check Credit Score: Make sure your credit score meets the lenders requirements to increase chances of approval.

- Gather Documentation: Lenders will ask for financial statements, tax returns and possibly a business plan.

- Submit an Application: Applications can be submitted online or in-person depending on the lender.

- Review the Loan Agreement: If approved review the loan agreement before signing to know the terms and conditions.

Term Loans vs Line of Credit

- Lump Sum vs Revolving Credit: Term loans are a one-time lump sum, lines of credit is revolving, you can borrow and repay as needed.

- Fixed Interest vs Variable Rates: Term loans have fixed interest rates, budgeting is predictable. Lines of credit have variable rates that changes over time.

- For Specific vs Ongoing: Term loans are for big one-time expenses like equipment purchase. Lines of credit is for cash flow management and ongoing expenses.

How to Qualify for a Business Term Loan

Meet the lenders requirements to increase your bank loan chances of approval:

- Credit Score and Revenue Requirements: Make sure your business meets the credit score and revenue criteria.

- Documentation: Lenders may ask for financial statements, tax returns and a business plan.

- Solid Business Plan: Show that you have a clear plan on how you’ll use the loan and a plan for repayment.

- Use of Funds: Lenders prefer when borrowers have a specific purpose for the loan like expanding operations or buying new equipment.

Repayment

Repayment options for small business loan and term loans:

- Fixed Monthly Payments: These payments are the same every month and makes budgeting easier. Repayment terms are usually 1-5 years.

- Variable Payments: Some lenders offer variable payments based on a percentage of sales which can be helpful if your revenue fluctuates.

- Balloon Payments: For larger loan amounts a balloon payment may be required at the end of the loan term.

- Prepayment Penalties: Some loans have penalties if you repay the loan early. Check your loan terms to see if this applies.

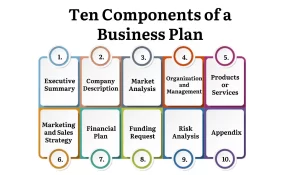

Business Plan

A business plan is required especially when applying for larger short term loans here. Here are the key elements to include:

- Business Goals: What do you want to achieve with the loan.

- Financial Projections: Lenders want to see financial forecasts and cash flow projections.

- Market Analysis: Show your understanding of your target market and competition.

- Sales Strategy: How will you generate revenue and grow your business.

Apply

Here’s a quick summary of the application process:

- Gather Documentation: Collect financial statements, tax returns and other required documents.

- Apply: Apply online or in person.

- Review and Sign: If approved, review the loan agreement to make sure you understand all the terms.

- Get Funded: Once signed, the lender will disburse the funds and you’ll start repaying according to the agreed terms.