In today’s fast-paced world, having quick access to money is essential. With unexpected expenses cropping up when you least expect them, cash advance apps like Albert have become a popular solution. But what exactly are Albert cash advance requirements, and how does this system work?

If you’re considering using Albert or are simply curious about its features, you’ve come to the right place. We’ll walk through everything from eligibility requirements to cash advance features so you know exactly what to expect.

What is Albert Cash Advance?

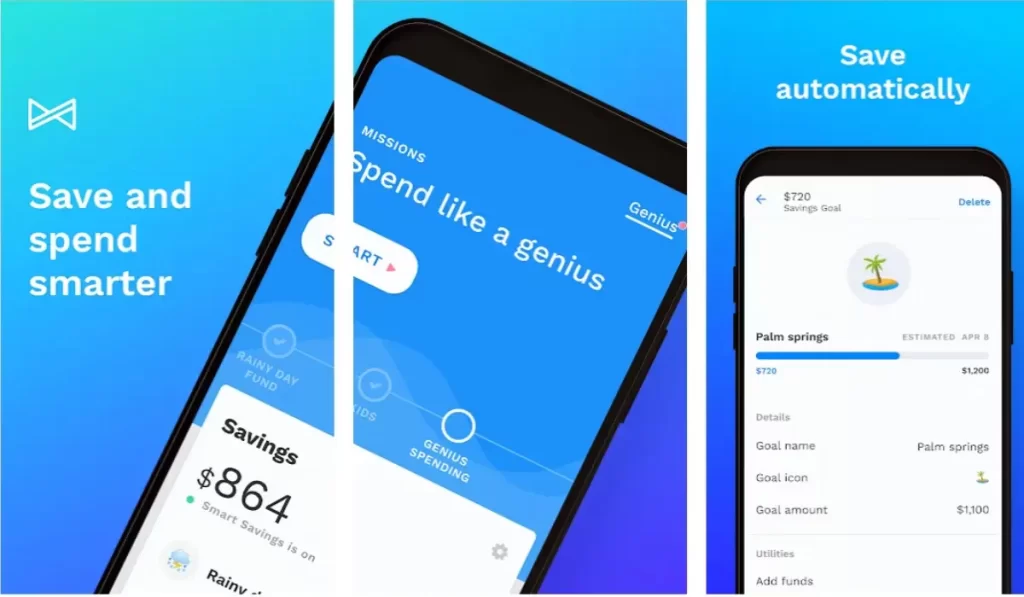

Albert is a financial service app designed to help users manage their money more efficiently. One of its standout features is the cash advance, which allows users to borrow money before their next payday or paycheck arrives. This is a great option for those who need quick funds without relying on high-interest payday loans or dealing with overdraft fees.

But before diving in, you need to understand the Albert cash advance requirements to make the most of the app’s offerings.

Related: Cash Advance Loans No Credit Check: Quick, Reliable Financial Relief!

- Earn up to 20% cash back

- Identity protection

- Get paid up to 2 days early

- Fee-free ATMs

4.5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Access up to $225

- Zero interest

- No late fees

- No credit check

3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Access up to $3750

- No late fees

- No credit check

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Eligibility Criteria for Albert Cash Advance

To be eligible members qualify for an Albert cash advance, you’ll need to meet certain criteria:

- Linked Bank Account: You must have a valid, active bank account. This allows Albert to monitor your spending and determine when to offer a cash advance.

- Regular Income: You need to have consistent direct deposits, typically from an employer. The app uses this to ensure you can repay the advance with your next paycheck.

- Direct Deposit Requirement: While having a direct deposit is key, Albert also looks at how regularly you receive funds into your bank account.

- Genius Subscription: Some features, like higher instant limits or quicker cash advances, are available if you subscribe to Albert’s Genius subscription plan.

How Much Can You Borrow with Albert?

Albert offers cash advances ranging from $20 to $250. The exact amount you can borrow depends on factors like your income, banking history, and spending habits. Most users, especially those with consistent paychecks and solid checking account activity, are eligible for higher advances.

The average approved limit tends to be around $100 but can vary.

The Importance of Direct Deposits

Having direct deposits in your linked bank account is a big factor for Albert when determining if you qualify for a cash advance. Direct deposits show that you have a steady income, and that’s why Albert can trust you’ll repay the advance from your next paycheck.

If your paycheck hasn’t arrived in your checking account just yet, Albert may still let you borrow money. However, consistent income from direct deposits can increase your chances of approval and even unlock higher limits for personal loans.

Related: Unlock Albert Instant Cash: Fast, Interest-Free Advances

Cash Advances vs. Payday Loans: Why Albert is Better

Albert stands out compared to traditional payday loans in several ways:

- No Interest: Albert doesn’t charge interest on cash advances, while payday loans often come with steep interest rates.

- Flexible Repayment: While payday loans usually have strict repayment deadlines, Albert offers flexible repayment tied to your paycheck.

- No Credit Check: With payday loans, you might face a credit check, but with Albert, there’s no need to worry. The app doesn’t run credit checks so that it won’t impact your credit score.

What Happens If You Miss a Payment?

Albert doesn’t impose late fees if you’re unable to repay your advance on time. However, it’s essential to repay the advance as soon as your full paycheck hits, next full paycheck hits, or the next payday pay period hits. Missing repayments per pay period could make it harder for you to get future advances, and it may lower your instant limit.

Overdraft Coverage with Albert

Albert offers overdraft coverage, meaning that if your savings account runs low, they let you borrow money and can still cover small expenses without worrying about overdraft fees. However, to qualify for this feature, you must have an active bank account and regularly receive direct deposits to an external account.

Related: Albert Cash Advance: Apps That Work Best

How to Get Albert Cash Advances Faster

To speed up the process of getting an advance, follow these tips:

- The Genius subscription unlocks more features, such as faster access to cash advances and overdraft protection.

- Ensuring your paycheck goes directly into your Albert cash account can improve your chances of getting approved for larger amounts.

- If Albert notices you’re frequently overdrawing or running low on funds, this may affect your ability to get a higher advance.

Overdraft Fees vs. Albert’s Fee-Free Model

Many traditional banks charge overdraft fees when you go below a zero balance. However, Albert operates bank accounts on a fee-free model. This means you won’t have to worry about steep overdraft fees cons used to cover small expenses.

Albert’s Subscription Fee: Is It Worth It?

Albert offers its premium Genius subscription for a small monthly fee. This monthly subscription fee can range from $$ per pay period $6 to $16, depending on what services you want access to, such as budgeting tools and financial advice. The Genius plan also enhances your experience with Albert, allowing you to access faster cash advances and instant overdraft coverage.

Albert vs. Other Cash Advance Apps

How does Albert compare to other cash advance apps? Many apps offer similar services, but Albert stands out due to its flexibility, lack of fees, and overall simplicity. While apps like Dave or Earnin may also provide cash advances, Albert’s Genius monthly subscription fee and additional features, such as financial tools and overdraft protection, give it an edge.

Is There a Credit Check?

Unlike many financial services, Albert doesn’t run a credit check to determine if you’re eligible for a cash advance. This is great news if you want to avoid hurting your credit score or are rebuilding your credit history.

Albert Savings and Investment Accounts

In addition to cash advances, Albert also offers savings accounts and investment accounts to help users grow their money. By using their Albert savings accounts, users can automate their savings goals while still having access to quick cash advances when needed.

Related: Why Albert is No.1 Cash Advance App in USA 2024?

How Albert Protects Your Information

Albert takes user privacy seriously, utilizing SSL and other technologies to protect your sensitive data. Plus, any funds deposited into your Albert account are held at FDIC-insured banks, such as Sutton Bank, so you can rest assured your money is safe.

Albert offers a fast, reliable way to access cash before next payday. By meeting the Albert cash advance requirements, you can benefit from no-interest loans, fee-free overdraft coverage, and quick access to funds. Whether you’re facing an unexpected expense or need a financial cushion, Albert is an excellent alternative to payday loans and other costly solutions.

While we’ve already covered some of the basics of the Albert Cash Advance app and requirements, there are still many more aspects to explore about the full cash advance app. Albert is more than just a quick cash advance solution. The full cash advance app offers a range of features that can improve your overall financial health. Let’s dig into some of these advanced features and see how they can help you manage your money.

Albert’s Smart Money Management Tools

One of the best things about the Albert app is how it helps you understand your spending habits. It’s not just about borrowing money quickly; it’s also about helping you save and spend wisely. The app gives you insights into where your money is going and how you can cut down on unnecessary expenses.

If you’re someone who tends to overspend, Albert’s smart money schedule can help you your smart money schedule stay on track. It analyzes your spending and lets you know when you’re about to go over your budget. This way, you won’t end up needing a cash advance because you’ve already managed your money more efficiently.

Albert’s Savings Features

Another handy feature Albert offers is the ability to save money automatically. The app takes small amounts from your linked bank account and puts them into your Albert savings account.

This is done based on your income and expenses, so it never takes out more than you can afford. Over time, this feature helps you build an emergency fund without even thinking about it.

The Albert savings accounts are also a great place to store extra cash, so you don’t have to rely on cash advances as much. With this feature, you can avoid overdraft fees and build up a small financial cushion for unexpected expenses in the future.

Borrow Money Instantly with Albert Instant

If you’re ever in a financial pinch, Albert’s instant cash advance feature can help you out. This feature allows you to either borrow money instantly get an advance on your next paycheck without any delay. While most cash advance apps take a few business days to transfer money, Albert’s instant transfer money back feature can provide the funds within minutes.

However, you’ll need to be enrolled in the Genius subscription to get early access to this quick service. If you haven’t subscribed, your advance may take a few days to show up in your account. So, if you often need immediate access or early access due to funds, it might be worth considering upgrading to the Genius subscription.

The Albert Debit Card

When you sign up for an Albert cash account, you’ll also get access to an Albert debit card. This card works just like any regular debit card and is linked directly to your Albert account. You can use it to make debit card purchases, pay bills, or withdraw cash from ATMs.

Having the Albert debit card can also help you track your spending more closely. Since the debit card purchases and is linked to your Albert account, all your transactions show up in the app. This makes it easier to monitor your finances and ensure you don’t overspend.

Related: Cash Advance Loans No Credit Check: Quick, Reliable Financial Relief!

Overdraft Protection and Coverage

One of the biggest concerns people have about their bank accounts is overdraft fees. Overdrafting occurs when you spend more money than you have in your checking account, which leads to overdraft fees. These fees can add up quickly, especially if you’re already tight on cash.

Luckily, Albert offers overdraft protection to prevent this from happening. If you’ve signed up for the Genius subscription, Albert will cover small overdrafts on your account, saving you from unnecessary overdraft fees cons such. This instant overdraft coverage can come in handy when you’re in a bind and need to make a purchase but don’t have enough in your account at that moment.

Flexible Repayment Options

One of the standout features of Albert’s cash advance app is its flexible repayment options. With most cash advance apps, repayment is a mandatory fees due on a strict date, usually your last paycheck early next payday per pay period. If you don’ pay cycle can’t have enough funds by that time per pay period, however, you may face late fees or other penalties.

Albert, however, allows you to repay the advance when your next paycheck arrives. It automatically deducts the repayment from your account once the funds hit. But the best part?

If you don’t have a paycheck early enough to cover the full repayment, Albert won’t penalize you. This flexibility can make managing your finances much easier, especially during tight months.

Financial Tools and Budgeting Assistance

In addition to personal loans and offering cash advances, Albert also provides several financial tools to help you manage your money more effectively. From tracking your spending to giving you advice on how to to save money, Albert acts like a personal financial advisor in your pocket.

For example, the app’s budgeting tools allow you to see where your money is going each month. It breaks down your spending into categories, such as groceries, entertainment, and bills, so you can see where you might need to cut back. Having these insights can prevent you from needing a cash advance in the first place by helping you stay within your budget.

Albert’s No Hidden Fees Approach

One of the reasons people love Albert is because it doesn’t charge hidden fees. Many cash advance apps and traditional financial institutions will charge you for every little thing, from overdrafts to late payments. With Albert, you know exactly what you’re paying for.

The Genius subscription monthly fee also has a clear monthly fee, and there are no interest charges on the cash advances you take.

This fee-free model is a breath of fresh air compared to traditional banks, which impose extra charges at every turn.

- Earn up to 20% cash back

- Identity protection

- Get paid up to 2 days early

- Fee-free ATMs

4.5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Access up to $225

- Zero interest

- No late fees

- No credit check

3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Access up to $3750

- No late fees

- No credit check

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Is Albert Secure?

When it comes to managing money online, security is always a top concern. Albert uses SSL and other technologies to ensure that your data is kept safe. Additionally, your funds are held in FDIC-insured banks, like Sutton Bank, which means they’re protected in case anything happens.

Having this level of security is important, especially when you’re entrusting an app with your personal financial information. Albert takes the necessary steps to ensure your money and data are safe so you can use the app with confidence.

Avoiding Credit Checks with Albert

One thing that makes Albert stand out from multiple apps and traditional lenders is that it doesn’t rely on credit checks. If you’ve ever applied for a personal loan, you know how nerve-wracking it can be to have your credit score scrutinized. But with Albert, there’s no need to worry. The app looks at your income and bank activity instead of your credit score, which makes it accessible to a broader range of users.

This also means that using Albert won’t affect your credit. Unlike traditional loans, where missed payments can harm your score, Albert’s cash advance system doesn’t report to credit bureaus.

Coastal Community Bank and Albert Partnership

Albert partners with Coastal Community Bank to provide many of its banking services. This partnership ensures that the app can offer real banking services such as direct deposits, debit card transactions, and savings accounts.

Additionally, Coastal Community Bank is FDIC-insured, meaning that your funds are protected up to $250,000.

Having this bank partnership allows Albert to offer a more robust service compared to many other cash advance apps. It’s not just about borrowing money; it’s about having access to a full suite of financial and banking services.

What Sets Albert Apart from Other Apps?

There are many cash advance apps out there, but most don’t offer the range of services that Albert does. Apps like Dave, Earnin, and Brigit are popular, but they often focus solely on giving cash advances. Albert, on the other hand, acts as a complete financial tool, helping you budget, save, and manage your money all in one place.

By offering savings accounts, overdraft protection, and budgeting tools across multiple apps, Albert sets itself apart from the competition. It’s more than just an app for borrowing money; it’s a tool for improving overall financial health.

If you’re interested in signing up for Albert, the process is simple. You need to download the Albert app, create an account, and link your bank account. From there, you can start exploring all of the features, from cash back rewards give-back rewards to advances to savings.

Once you’re set up, you can request your first cash advance direct deposit. Depending on your banking history and the regularity of your direct deposits, you may be approved for a higher or lower amount of direct deposit.

Albert is more than just a cash advance app—it’s a comprehensive financial tool that can help you manage your money more effectively.

By understanding the Albert cash advance requirements, you can take full advantage of everything the app offers, from quick cash advances to smart budgeting and savings tools. Whether you’re trying to avoid overdraft fees, need fast access to funds, or want to save a little more, Albert has you covered.

It’s an all-in-one solution for your everyday financial needs, designed to help you stay in control of your money without the stress or hidden costs.

Related: Advance Loans for Bad Credit: A Simple Guide

Frequently Asked Questions

Does the Albert app give you $250?

Yes, Albert allows you to borrow up to $250 through its cash advance feature. The amount you qualify for depends on your income, direct deposit history, and overall banking activity. You can receive this advance with no interest, making it a quick and easy way to get immediate access to extra funds when needed.

Do you need available credit for cash advance?

No, you do not need available credit to use the Albert cash advance feature. Albert does not perform credit checks when determining eligibility. Instead, the app looks at your income, pay period, and bank account activity to decide whether you can receive a cash advance.

What do you need to borrow money from cash advance?

To borrow money from Albert’s cash advance, you need to have an active bank account, regular income, and a history of direct deposits into your account. You’ll also need to set up an Albert account and link it to your existing bank account. In some cases, you may be required to enroll in the Genius subscription to access certain features like the instant transfer of cash advances and electronic transfers.

Why did my Albert Instant go down?

Your Albert Instant limit can go down if there are changes in your paycheck schedule, external bank account and activity, or other factors related to your financial situation. Albert regularly reviews these factors to determine how much of a cash advance you can qualify for, so fluctuations in your income or external bank account balance may affect your instant limit.

What are the main Albert cash advance requirements?

To qualify for an Albert cash advance, you need an active bank account, consistent direct deposits to an an external account or bank account, and a monthly subscription fee preferably an Albert Genius subscription for faster and higher advances.

Is there a credit check for Albert’s cash advances?

No, Albert does not perform credit checks when approving cash advances, making it accessible for users with poor or no credit.

How fast can I get my cash advance from Albert?

If you have the Albert Genius subscription, cash advances can be available within minutes. Otherwise, they may take 1-3 business days.

Does Albert charge overdraft fees?

No, Albert does not charge overdraft fees. In fact, it provides overdraft coverage to help you avoid these charges altogether.

What’s the maximum amount I can borrow from Albert?

Depending on your banking history and account activity, you can borrow up to $250.

- Earn up to 20% cash back

- Identity protection

- Get paid up to 2 days early

- Fee-free ATMs

4.5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Access up to $225

- Zero interest

- No late fees

- No credit check

3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Access up to $3750

- No late fees

- No credit check

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Read More

Read More

2 Responses