When you’re in a tight spot and need cash fast, Albert Instant Cash might be the answer. With cash advance apps on the rise, Albert is one of the top dogs, giving you access to cash when you need it most. Whether it’s for unexpected expenses, avoiding overdraft fees or bridging the gap between paychecks, Albert’s got you covered.

In this article, we’ll go into everything about Albert Instant! Cash advance app, how it works and why millions of people use it. Let’s get into it.

What is Albert Instant Cash?

Albert Instant Cash is a feature of the Albert app, a financial app that helps you manage your money. This feature gives you access to up to $250 in cash advance with no interest, no credit checks and no late fees. Whether your paycheck is a day late or you have an unexpected expense Albert Instant Cash has you covered.

Albert’s cash advance service works through their Albert cash account, a checking account like feature within the app. This account allows you to receive direct deposits deposit bank,, make debit card purchases and even withdraw cash from ATMs.

How Does Albert Instant Cash Work?

Albert Instant Cash works like this. Once you’ve set up an Albert account you link it to your bank account. When you need cash fast the app checks your bank account activity and determines if you’re eligible for a cash advance. You can borrow up to $250 which is deposited into your Albert Cash account or linked bank account.

The cash advances have no interest or hidden fees although you can pay an express fee for faster transfers. You don’t have to worry about big overdraft fees or payday loans with crazy high interest rates anymore. Instead Albert offers a flexible repayment plan, the amount you borrowed will be deducted when your next paycheck hits.

Who is Albert Instant Cash For?

Albert Instant Cash is for anyone who needs to borrow money fast without the hassle. It’s for people who:

- Have unexpected expenses like car repairs, medical bills or utility payments.

- Want to avoid overdraft fees on their checking account.

- Need to bridge the gap until their next paycheck.

Features

- Direct deposit: Get your paycheck up to 2 days earlier than your pay period.

- Flexible repayment: No set repayment date – Albert takes the amount back when your next paycheck hits.

- No credit checks: Unlike loans Albert doesn’t check your credit score to determine if you’re eligible for a cash advance.

- No interest: Albert doesn’t charge interest on the money you borrow so you don’t get stuck in debt traps like payday loans.

- FDIC insured: Your funds in the Albert cash account are insured up to $250,000.

How to Get Albert Instant Cash

Getting Albert Instant Cash is easy. To be eligible, you must:

- Open an Albert account.

- Link your bank account to the app.

- Have a steady paycheck and regular income going into your account.

Albert looks at your linked bank account activity, your pay period and other factors to a credit check to determine if you’re eligible. The app doesn’t do credit checks, so your credit score won’t be affected.

Advantages

- Fast access to cash: Get up to $250 in minutes.

- No interest: Unlike loans or payday advances, Albert doesn’t charge interest.

- No overdraft fees: Albert helps you avoid big overdraft fees.

- Flexible repayment: Pay the loan back when your next direct deposit hits with no penalties or due dates.

Albert vs other cash advance apps

There are many cash advance apps out there, but Albert stands out with:

- Most cash advance apps charge interest or late fees; Albert doesn’t.

- Some apps require extensive credit checks or income verification, but Albert is more flexible.

- Many apps don’t offer direct deposit. Albert does.

- Other apps have hidden fees; Albert is transparent with their monthly subscription fee and express fee options.

How to use Albert Instant Cash

Using Albert Instant Cash is super easy. Here’s how:

- Download the Albert app from the App Store or Google Play.

- Create your Albert account and link it to your bank account.

- Apply for a cash advance through the app. Albert will look at your bank account activity and income to determine if you’re eligible.

- If approved, your cash advance will be sent to your Albert cash account or your linked bank account.

- Use your Albert cash to buy anything, pay bills or withdraw from an ATM.

Albert’s other services

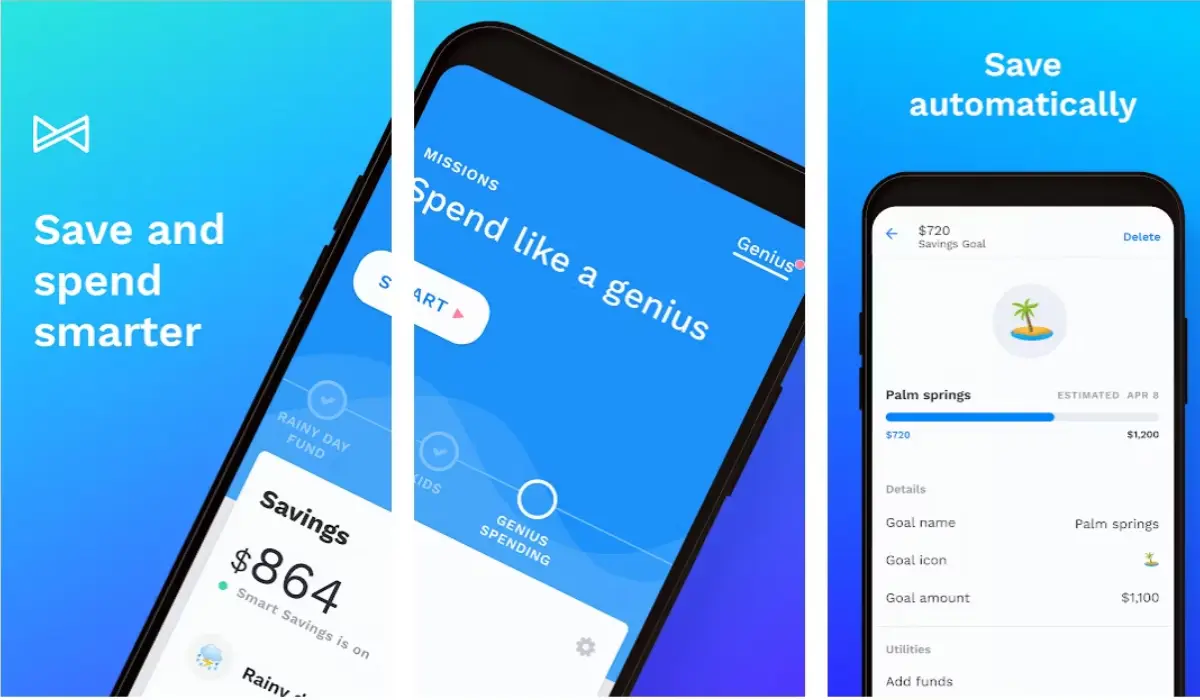

Besides Albert Instant Cash, the app has:

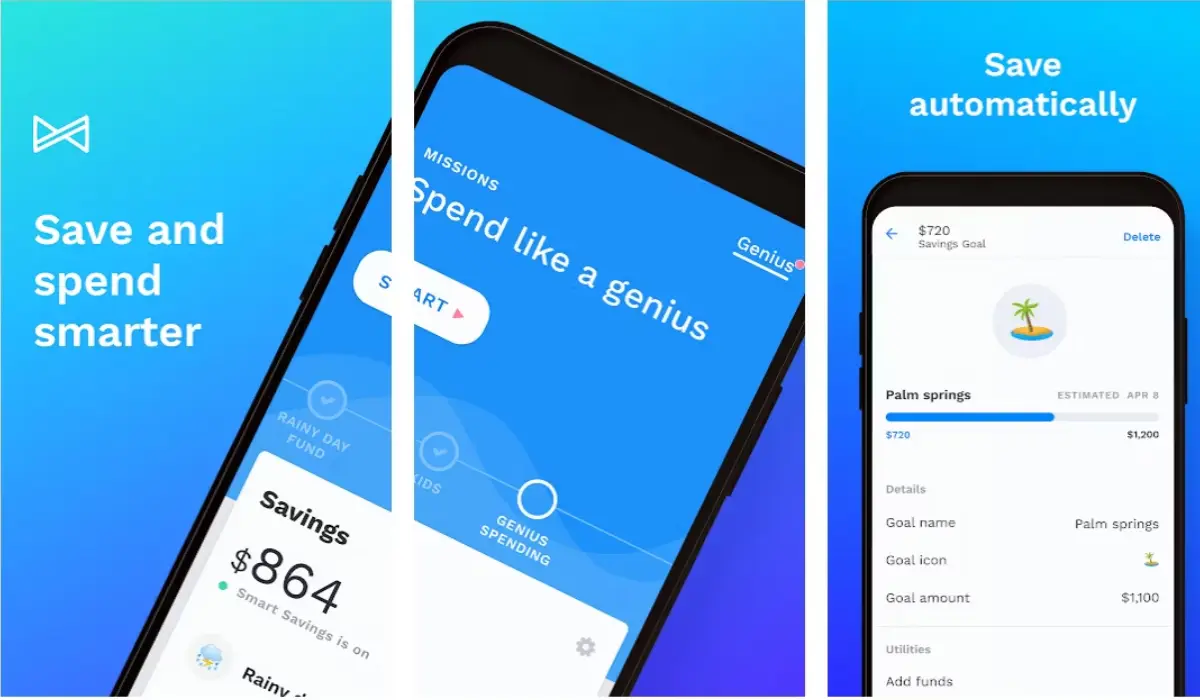

- Albert savings accounts: Save automatically through smart recommendations.

- Albert investing accounts: Invest with minimal effort through Albert’s investment advisory services.

- Albert bookkeeping: Track all your finances in one place.

- Albert Securities: Manage your investments through their brokerage services.

What about Albert’s fees?

Albert has a monthly subscription fee which is optional. But this fee gives you early access to to premium services like faster transfers and more financial tools. You may also pay an express fee if you need the cash advance transferred faster than the 2-3 business day standard.

No hidden fees, and Albert is transparent with their pricing.

Is Albert Instant Cash safe?

Yes, Albert is safe to use. The Albert cash account is FDIC-insured through Sutton Bank and Coastal Community Bank so your funds are protected up to $250,000. Albert also follows strict privacy and security protocols to keep your personal and financial info safe.

Can Albert help build credit?

While Albert Instant Cash doesn’t affect your identity and credit score so directly, the app can help you manage your finances better. By avoiding overdraft fees and paying back your advances on time, you can have a healthier financial life, which indirectly helps you build credit.

Albert Instant Cash is a lifesaver for anyone who needs a quick cash injection. No credit checks, interest or late fees, it’s one of the most flexible and easy-to-use cash advance apps out there.

Cash advance apps

Whether you need help between paychecks or just want to avoid big bank fees, Albert has you covered. It’s more than just a cash advance app with added financial tools, investment advisory, banking services, and premium features.

If you’re in a bind and need cash fast without the hassle of a loan application, Albert Instant Cash is worth it.

How Does Albert Instant Cash Differ from Traditional Loans?

Unlike traditional loans, Albert Instant Cash doesn’t involve a lengthy approval process, credit checks, or a stack of paperwork. With traditional loans, you often have to visit a bank, fill out a detailed application, and wait days or even weeks for approval.

These loans often require a high credit score, and many charge interest or have strict repayment schedules. In contrast, Albert allows users to borrow smaller amounts of money quickly and easily, without any interest or complicated terms.

The whole process is handled through the app, and the funds are typically available within minutes to a few days.

Traditional loans, especially payday loans, can come with extremely high interest rates, trapping people in a cycle of debt. Payday loans also require repayment within a short time, usually around your next pay period.

If you can’t repay the loan on time, you might face extra fees or penalties. Albert doesn’t charge interest or late fees, making it a safer option for short-term cash needs.

How to Set Up Your Albert Cash Account

Setting up your Albert cash account is simple. Once you download the app, you will be guided through the process of creating an account. Here’s a step-by-step guide:

- Download the Albert app: Available on both the Apple App Store and Google Play.

- Sign up for an account: Enter your basic information like name, email, and phone number.

- Link your bank account: This allows Albert to monitor your income and expenses, which helps them determine your eligibility for a cash advance.

- Set up direct deposit: If you want to get your paycheck early through Albert, you can switch your direct deposit to your Albert cash account.

- Request a cash advance: After setting up your account and linking your bank, you can apply for Albert Instant Cash when you need it.

Once your Albert account is set up, managing your finances becomes easier. You can view your balance, track expenses, and receive cash advances all in one place.

Albert Instant Cash and Overdraft Protection

One of the main reasons people turn to Albert Instant Cash is to avoid overdraft fees. Banks typically charge hefty fees if your bank account goes negative, which can make a tough financial situation even worse.

By using Albert Instant Cash, you can only let you borrow money just enough to cover your expenses, preventing your account from going into the negative. Albert’s ability to send you money before your next paycheck arrives can help you maintain financial stability.

Unlike many traditional banks that offer overdraft protection, Albert doesn’t charge additional fees for using this feature. You only pay back the amount you’ve borrowed when your next paycheck is deposited, making it a much cheaper and more convenient option.

Albert Instant Cash for Everyday Expenses

Albert Instant Cash isn’t just for emergencies. It can also be used to manage regular expenses like groceries, gas, or even a night out. Imagine you’re a few days away from payday, but your bank account is running low.

Rather than worrying about how to make it until your next paycheck, Albert provides you with the financial cushion you need. Whether you’re using it to cover a debit card purchase or pay a bill, the ability to borrow money instantly is incredibly useful in everyday situations.

For many people, budgeting and managing expenses can be tricky. That’s where Albert’s other tools, such multiple apps such as budgeting tools and savings advice, come in handy. They help you keep track of your spending and ensure that you stay on top of your financial goals.

Why Albert Is a Great Choice for First-Time Borrowers

If you’re new to borrowing money or hesitant to apply for a loan due to your credit score, Albert Instant Cash is a great option. Unlike many other cash advance apps, Albert doesn’t require a credit check. This means that even if you have a poor or limited credit history, you can still access a cash advance when needed.

Additionally, Albert doesn’t penalize you for borrowing money. With no interest or late fees, first-time borrowers can feel confident that they won’t get stuck in a cycle of debt. This makes Albert a smart choice for younger individuals or those who are just starting to learn about personal finance.

How Albert Helps You Save and Invest

Albert goes beyond just offering cash advances. The app also helps you save and invest your money. If you’re someone who struggles to save, Albert savings accounts can automatically set aside money for you. Albert uses smart algorithms to analyze your spending habits and determine how much you can safely save. This way, you’re building up savings without even realizing it.

Albert also offers investment advisory services, where you can start investing with as little as $1. Whether you want to build long-term wealth or just put away a little extra for the future, Albert makes it easy to start investing. Plus, they offer Albert investments and brokerage services to help you grow your money over time.

Managing Multiple Accounts with Albert

Another advantage of Albert Instant Cash is that it works seamlessly with multiple accounts. If you have more than one bank account, Albert can track them all in one place, giving you a clear overview of your financial situation. This is especially helpful if you have accounts at different banks or need to move money between them. Albert simplifies this process by allowing you to manage your funds efficiently.

Albert also tracks your spending across all accounts, giving you insights into your spending habits. This helps you identify areas where you can cut back and save more. Whether you’re paying bills, using multiple debit cards, or transferring money, Albert makes it easy to stay organized.

What to Consider Before Using Albert Instant Cash

While Albert Instant Cash offers many benefits, it’s essential to use it wisely. Since the cash advance is meant to be paid back when your next paycheck arrives, you’ll need to ensure that you can afford the repayment. Borrowing too frequently or without a plan could lead to financial stress.

Additionally, while Albert doesn’t charge interest for electronic transfers, using the express fee for faster transfers can add up over time. It’s always best to plan ahead and avoid using the express service unless absolutely necessary.

If you’re managing multiple cash advances or using several cash advance apps, it can also become easy to lose track of what you owe. Albert helps prevent this with reminders and automatic repayments, but it’s still essential to stay on top of your finances.

How Albert Protects Your Information

One common concern with using financial apps is security. Albert takes this seriously and offers top-notch security features. All your transactions and personal information are encrypted, and Albert adheres to strict privacy standards.

Your money in the Albert cash account is FDIC-insured through their partner banks, Sutton Bank and Coastal Community Bank. This means that your funds are protected, just like they would be in a traditional bank.

Albert Instant Cash and Financial Wellness

At its core, Albert is about helping you achieve financial wellness. By offering a combination of cash advances, budgeting tools, savings options personal loans, and investment opportunities, Albert provides a full suite of financial services. Whether you’re just starting to manage your money or looking for ways to grow your wealth, Albert gives you the tools and knowledge you need to succeed.

The app also connects you with finance experts, who can answer your questions and provide personalized advice. Whether you’re wondering about your credit score, trying to plan for a big purchase, or need help with budgeting, Albert’s finance experts are there to guide you.

Are There Any Downsides to Using Albert Instant Cash?

While Albert Instant Cash is generally a great tool, there are a few potential downsides to consider:

- Limited loan amount: The maximum amount you can borrow is $250, which may not be enough for larger expenses.

- Subscription fees: While the basic version of Albert is free, certain premium features require a monthly subscription fee.

- Express fee: If you need your funds transferred immediately, you’ll have to pay an express fee, which could add up over time.

Despite these minor drawbacks, Albert remains a solid choice for anyone in need of quick cash.

Frequently Asked Questions

How does Albert Instant Cash work?

Albert Instant Cash allows you to borrow up to $250 with no interest or credit checks. You link external account to your bank account and if eligible Albert deposits the funds into your Albert cash account.

Does the Albert app give you $250?

Yes, eligible users can borrow up to $250 through the Albert Instant Cash feature.

How to qualify for Albert?

You must have an Albert account, a linked bank account and a steady, consistent income amount. Albert reviews your financial habits and account activity to determine eligibility.

Which app can lend you cash now?

Several apps can lend you money now but Albert Instant Cash is unique with no interest, credit checks or hidden fees.

Is Albert Instant Cash better than payday loans?

Yes, Albert Instant Cash is way better than payday loans.

Read More

Read More