Discover the top business credit cards for August 2024, offering the best rewards, low interest rates, and exclusive perks. Compare and choose the perfect card to boost your business’s financial health today. Owners of companies are aware that every dollar matters. Making the most of business transactions can be achieved by employing a company credit card.

Numerous advantages may be obtained with business credit cards. These include cash back or prizes, loyalty points, trip insurance, and cost control. Determining which elements are most important to your company and what you value most—rewards, cash back, or credit-building assistance—will help you select the finest business credit cards.

Related: Credit Cards Trends And Predictions by Market Expert

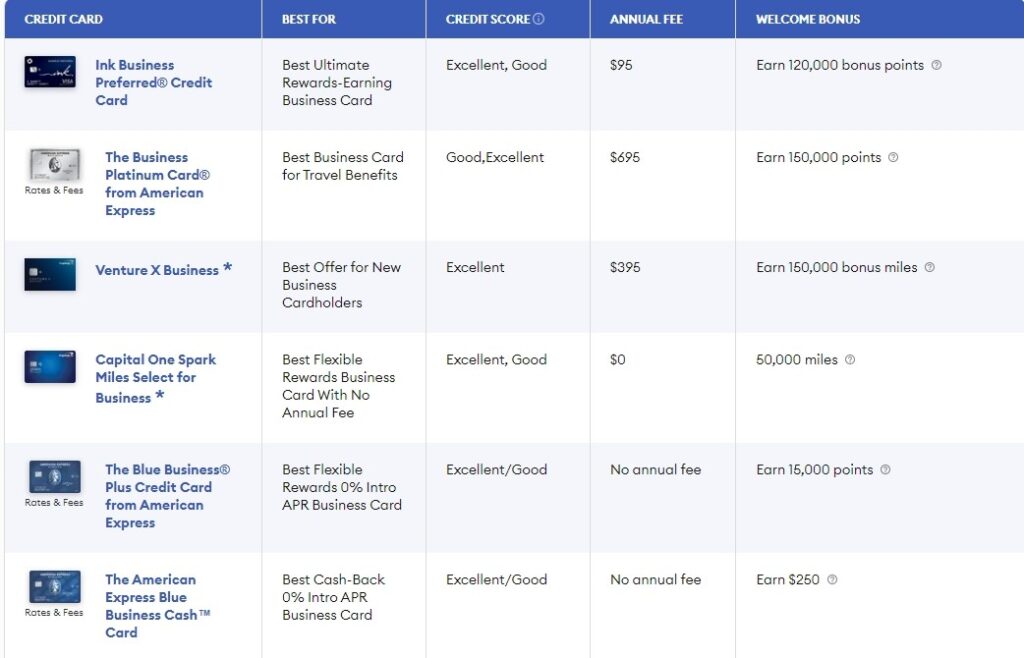

Best Business Credit Cards of 2024

Best Ultimate Rewards-Earning Business Card

The Ink Business Preferred® Credit Card is an excellent option for business travel, offering attractive bonus offers and the opportunity to earn significant Chase Ultimate Rewards® points at competitive rates. The flexibility of Ultimate Rewards makes them desirable. You can transfer points to other reward programs, such as United, Southwest, and Hyatt, or redeem directly through Chase TravelTM at a rate of 1.25 cents per point. This card is a smart financial move for your business.

Rewards: Earn one point for every dollar spent on all other purchases and three points for every dollar spent on travel and specific business categories on your account anniversary year.

Welcome, offer: Spend $8,000 on purchases during the first three months of creating your account to receive 120,000 bonus points.

Annual Fee: $95

Other advantages and disadvantages: The “select business categories” cover social media and search engine advertising, travel, internet, cable and phone, and shipping. This card is going to pay off if your company advertises heavily online.

Balances can be rapidly increased by combining personal Ultimate Rewards points with Ultimate Rewards from the Chase Ink Business Preferred.

This card also includes primary auto rental insurance when renting for a business, extended warranty coverage, purchase protection, travel cancellation and interruption insurance, and smartphone insurance with up to three $1,000 claims per year, subject to a $100 deductible.

Best Business Card for Travel Benefits

The American Express Business Platinum Card® (terms apply; see rates & fees) has a hefty annual charge, but it’s an excellent choice for companies that value travel advantages. This card offers unrivalled benefits, making you feel like a privileged traveller.

Rewards: Earn 5 points per dollar through Membership Rewards® for travel through American Express Travel, 1.5 points per dollar for eligible purchases made at U.S. suppliers of hardware and construction materials, electronic goods stores, software and cloud system providers, shipping companies, and on purchases of $5,000 or more anywhere else. You can earn 1 point per dollar for other eligible purchases and up to $2 million per calendar year.

Welcome, offer: Earn 150,000 Membership Rewards® points after spending $20,000 on eligible purchases with the card in the first three months of membership.

Annual Fee: $695.

Additional perks and drawbacks: This card must include the following benefits: Cardholders gain airport club access through the American Express Global Lounge Collection and elite status after enrolling in travel companies such as Hilton, Marriott, Avis, National, and Hertz. Statement credits are plentiful in the first year of membership, with the ability to earn credits for eligible spending on airline incidentals charged by your one selected airline, a CLEAR® Plus membership, Dell Technologies through 12/31/24, Indeed through 12/31/24, Adobe through 12/31/24, and more (enrollment required for select benefits). Businesses using all (or many) of these incentives can find this card useful.

Best Offer for New Business Cardholders

The Venture X Business offers to earn transferable miles on every purchase with no restrictions (and at a high rate), appealing to business owners who value travel perks and incentives. This flexibility empowers you to make the most of your business expenses.

Rewards: Earn 10 points per dollar on hotel and rental car reservations made through Capital One Travel, 5 miles per dollar on flights booked through Capital One Travel, and 2 miles per dollar on other qualified transactions.

Welcome, offer: Earn 150,000 bonus miles by spending $30,000 during the first three months after account opening.

Annual Fee: $395.

Additional perks and drawbacks: The annual Fee on this card is a possible stumbling barrier, but anyone who can take advantage of the $300 annual travel credit for purchases made through Capital One Travel may be ready to overlook it. The card provides essential features, such as access to Priority Pass and Capital One airport lounges, which make the cost reasonable. But there are certain drawbacks. The card needs full payment, which may be a deal-breaker if cash flow is limited. Furthermore, the impressive welcome gift necessitates significant spending.

Business Loans

02

5

Average Review

Business Loans

- Provides data-driven financial solutions

- Loan amount: $15K - $1M

- Time in business: 12+ months

- $12.5K in monthly revenue

- Minimum credit score: 600

Read More

Read More

One Response