If you have weak or poor credit, as defined by FICO (a score of 350 to 579), you will be unable to obtain a personal loan unless you apply with a cosigner. While some personal loans require a credit score of at least 670, several lenders, including those on this list, are ready to offer money to those with credit scores between 580 and 600.

Personal loan interest rates fluctuate depending on your credit score and eligibility conditions, so you should not expect to get the best rates or terms if you have bad credit.

Best personal loan

- Est. APR = 6.99%

- Loan type : Personal

- Loan amount: $1k - $50k

- Min credit score: 580

4.3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 6.99-35.99%

- Loan Amount = $100-$40K

- Min Credit Score = 300

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 9.99 - 39.99%

- Loan Amount = $1k - $50k

- Min Credit Score = 580

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Personal Loan for No Credit

- Est. APR 7.80% - 35.99%

- Loan amount $1k– $50k

- Min credit score 300

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99% to 35.99%

- Loan amount $500 to $5,000

- Min credit score = Any

3.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99%-35.99%

- Loan amount $1Kto $35K

- Min credit score = 580

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Flexible loan amounts

- 24/7 Support

- No prepayment fees

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Bad Credit Loans Of August 2024

- Upgrade – Best Overall Installment Loan For Bad Credit

- LendingPoint – Best for Fast Funding and Below-Average Credit.

- Universal Credit – Ideal for Comparing Multiple Offers

- Upstart provides quick approvals, while Avant offers a variety of repayment options.

- LendingClub – Best Online Experience

Related: Whom to prefer for personal loans? Personalloans or Badcreditloans

Tips for Comparing Personal Loans for Bad Credit

Consider these suggestions when comparing personal loans with weak credit:

- Compare the high-end range of interest rates. Because interest rates are heavily influenced by your qualifying credit score, you’re more likely to get the highest rate possible if you have bad credit. So, while comparing personal loans for persons with terrible credit, make sure to consider the maximum rate.

- If feasible, get prequalified with a provider. Several sources can prequalify you for a personal loan. This means you can find out about prospective loan limits, rates, and payback alternatives by providing information such as your income, preferred loan use, and housing circumstances. Prequalifying also involves a soft credit check, which does not harm your credit score, so you may securely locate the finest.

- Check for any extra fees. Some personal loan companies do not charge any origination fees, late fees, or prepayment penalties. However, some may charge all or part of these fees. When comparing bad credit personal loans, make sure to consider the fees in addition to the prospective interest rate.

- Evaluate the lender’s customer service choices. If you have selected a lender, there is one more thing to think about before signing the loan agreement. While customer service may not appear to be a major matter, it can make a significant impact if you have payment troubles or have financial difficulties during your payback time. Check the lender’s customer service resources and read reviews to ensure it’s a good fit.

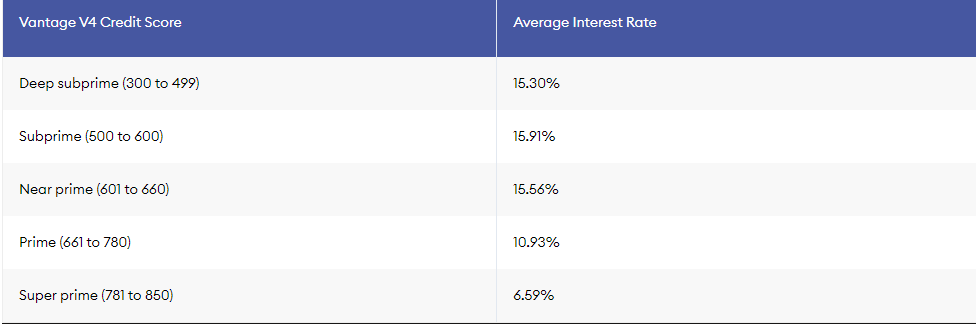

Current Bad Credit Loan Interest Rates

Average Personal Loan Interest Rates by Credit Score

Can you get a personal loan with a credit score of 550?

There are few lenders who accept applications from borrowers with credit scores of 550. However, some lenders accept a co-signer—someone who promises to repay the loan if the principal borrower is unable to do so—which can enable you qualify for a loan with a 550 credit score. If you know you have bad credit, work to repair it before applying for a personal loan.

How much money can you borrow with bad credit?

A lender normally bases your loan limit on your creditworthiness and income. The highest limits are allocated for highly qualified borrowers. If you have bad credit, you might expect to receive close to your lender's minimal loan limit. If you need to borrow more money, try increasing your credit score before applying.

How do you fix bad credit to get a better loan?

If you have bad credit and want to apply for a loan, take the time to improve your credit score. Some popular ways to accomplish this include paying off your existing debts, minimizing your overall credit usage, disputing any inaccuracies on your credit report, and limiting the amount of new credit applications filed in a short period of time.

Best personal loan

- Est. APR = 6.99%

- Loan type : Personal

- Loan amount: $1k - $50k

- Min credit score: 580

4.3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 6.99-35.99%

- Loan Amount = $100-$40K

- Min Credit Score = 300

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 9.99 - 39.99%

- Loan Amount = $1k - $50k

- Min Credit Score = 580

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Personal Loan for No Credit

- Est. APR 7.80% - 35.99%

- Loan amount $1k– $50k

- Min credit score 300

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99% to 35.99%

- Loan amount $500 to $5,000

- Min credit score = Any

3.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99%-35.99%

- Loan amount $1Kto $35K

- Min credit score = 580

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Flexible loan amounts

- 24/7 Support

- No prepayment fees

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Read More

Read More