Discover the best personal loans for fair credit in 2024. Compare top lenders, interest rates, and loan terms to find the right option for your financial needs. Tips for improving approval chances are included.

Finding one that fits your needs can feel like an uphill battle. When you have fair credit, which typically falls between 580 and 669 in the FICO range, it doesn’t give you access to the best loan offers, but it also doesn’t leave you altogether out of options.

Fortunately, some lenders specialize in offering personal loans to individuals with fair credit, providing a lifeline for those looking to finance a significant expense, consolidate debt, or cover an unexpected cost.

Related: How to Repair Your Credit Score

Best personal loans for fair credit

What is Fair Credit?

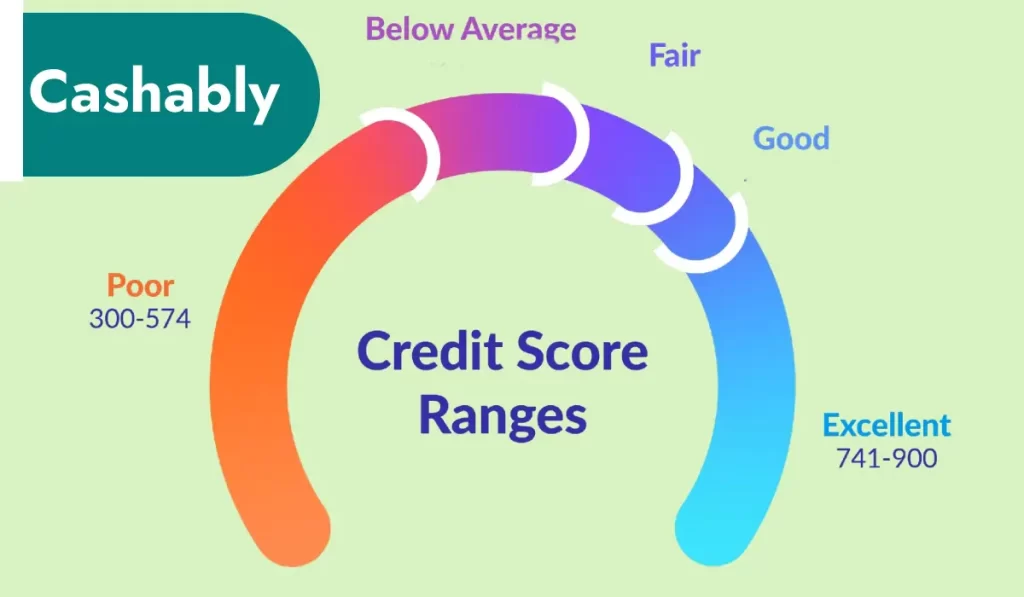

Explanation of Credit Score Ranges

Credit scores are numerically representative, ranging from 300 to 850. This range is generally divided into categories:

- Poor Credit: 300-579

- Fair Credit: 580-669

- Good Credit: 670-739

- Very Good Credit: 740-799

- Excellent Credit: 800-850

How Fair Credit is Determined

Fair credit is typically the result of a few missed payments, a high credit utilization ratio, or a limited credit history. While it’s better than poor credit, it still indicates to lenders that you may pose a higher risk than someone with good or excellent credit.

Impact of Fair Credit on Loan Options

Having fair credit means you’ll likely have higher interest rates and less favorable terms than those with good or excellent credit. However, it also means you have more options available with poor credit.

Continue Reading: Best Personal Loans For Bad Credit Of August 2024

Why Consider Personal Loans with Fair Credit?

Benefits of Personal Loans for Fair Credit Holders

Personal loans can be valuable for those with fair credit. They can help you consolidate high-interest debt, cover emergency expenses, or finance a large purchase. With fixed interest rates and regular monthly payments, personal loans provide a level of pry that can make budgeting easier.

Challenges Faced by Fair Credit Holders in Securing Loans

While personal loans offer numerous benefits, fair credit holders may face challenges such as higher interest rates and stricter loan terms. Additionally, the variety of offers makes finding the best loan for your situation challenging.

Related: Personal Loans with Bad Credit | Best For Poor Credit Score

Factors to Consider When Choosing a Personal Loan

Interest Rates

Interest rates are one of the most critical factors to consider. With fair credit, you’ll likely see rates higher than those offered to borrowers with good or excellent credit. Shopping around to find the best rate available to you is essential.

Loan Terms and Conditions

Loan terms, including the length of the loan and the monthly payment amount, can vary significantly between lenders. Make sure you understand all the terms before agreeing to a loan.

Fees and Penalties

Some personal loans have origination fees and late or prepayment penalties. Be sure to read the fine print to avoid any unexpected costs.

Loan Amounts and Repayment Flexibility

Consider how much you need to borrow and whether the lender offers the required loan amount. Also, look for lenders that provide repayment flexibility, such as choosing your payment date or making extra payments without penalty.

Top Lenders Offering Best Personal Loans for Fair Credit

Overview of Top Lenders

Several lenders specialize in offering personal loans to those with fair credit. Here’s a look at some of the top options:

Key Features of Each Lender

Each lender has unique features that may appeal to different borrowers, depending on their financial needs and goals.

Comparison of Interest Rates and Loan Terms

Comparing interest rates and loan terms is crucial to finding the best loan. Below, we provide detailed reviews of the top lenders to help you make an informed decision.

Related: Best Personal Loans For Bad Credit Of August 2024

Detailed Reviews of Top Lenders

Lender 1: LendingClub

LendingClub is a popular online lender that offers personal loans to borrowers with fair credit. Typically range from 8.05% to 36%. Loans range from $1,000 to $40,000 with terms of 3 to

Lender 2: Avant

Avant is known for its quick approval process and flexible loan options. Typically range from 9.95% to 35.99%. Loans range from $2,000 to $35,000 with terms of 2 to

Lender 3: Upstart

Upstart uses artificial intelligence to assess borrowers, making it a good option for those with limited credit history. Typically range from 6.18% to 35.99. Loans range from $1,000 to $50,000 with 3 to 5-year terms.

Best personal loan

- Est. APR = 6.99%

- Loan type : Personal

- Loan amount: $1k - $50k

- Min credit score: 580

4.3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 6.99-35.99%

- Loan Amount = $100-$40K

- Min Credit Score = 300

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 9.99 - 39.99%

- Loan Amount = $1k - $50k

- Min Credit Score = 580

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Personal Loan for No Credit

- Est. APR 7.80% - 35.99%

- Loan amount $1k– $50k

- Min credit score 300

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99% to 35.99%

- Loan amount $500 to $5,000

- Min credit score = Any

3.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99%-35.99%

- Loan amount $1Kto $35K

- Min credit score = 580

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Flexible loan amounts

- 24/7 Support

- No prepayment fees

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Lender 4: OneMain Financial

OneMain Financial offers personal loans to borrowers with less-than-perfect credit and has physical branches for in-person service. Typically range from 18% to 35.99%. Loans range from $1,500 to $20,000 with terms of 2 to

Lender 5: Upgrade

Upgrade offers personal loans with low fees and a focus on debt consolidation. Rates typically range from 8.24% to 35.97%. Loans range from $1,000 to $50,000, with 3 to 7-year terms.

Related: How to Get a Personal Loan With Bad Credit

Pros and Cons of Personal Loans for Fair Credit

Advantages

- Access to Funds: Personal loans can provide quick access to funds for various needs.

- Fixed Interest Rates: These loans typically come with fixed rates, making budgeting easier.

- Debt Consolidation: Personal loans can help consolidate high-interest debt into a single, lower-interest payment.

Disadvantages

- Higher Interest Rates: Fair credit holders may face higher interest rates, increasing the loan cost.

- Limited Loan Amounts: Some lenders may offer lower loans to those with fair credit.

How to Improve Your Chances of Approval

Tips for Improving Credit Score

Improving your credit score can increase your chances of securing a better loan. Pay bills on time, reduce credit card balances, and avoid applying for new credit before seeking a loan.

How to Present Your Financial Situation to Lenders

When applying for a loan, clearly describe your situation. This includes showing steady income, reducing debt-to-income ratios, and being transparent about any financial challenges you’ve faced.

Common Mistakes to Avoid When Applying for Personal Loans

Not Comparing Loan Options

Failing to compare different loan options can lead to higher costs and less favorable terms. Always shop around.

Ignoring Fees and Penalties

Some loans come with hidden fees that can increase your costs. Make sure to read the fine print.

Borrowing More Than You Need

It can be tempting to borrow more than you need, but this increases your debt and the amount of interest you will pay for a Personal Loan Responsibly.

Budgeting and Repayment Strategies

Create a budget that includes your loan repayment to ensure you can meet your monthly obligations without falling behind.

Avoiding Debt Traps

Only borrow what you can afford to repay, and avoid using loans to cover recurring expenses, as this can lead to a cycle of debt.

Alternatives to Best Personal Loans for Fair Credit Holders

Credit Unions

Credit unions often offer personal loans to their members with more favourable terms to their members with fair credit.

Secured Loans

If you have assets, consider a secured loan, which may offer lower interest rates than unsecured personal loans.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual investors, often providing more flexible loan terms.

Securing a personal loan with fair credit may come with challenges, but it’s far from impossible. By understanding your options, comparing lenders, and improving your credit score, you can find a loan that meets your needs without breaking the bank. Remember to borrow responsibly, consider alternatives, and read the fine print before committing to a loan.

Frequently Asked Questions

What is considered a fair credit score?

A fair credit score typically ranges from 580 to 669 on the FICO scale.

Can I get a personal loan with fair credit?

Yes, many lenders offer personal loans to individuals with fair credit, though the terms may not be as favourable as those for borrowers with higher credit scores.

What are the interest rates for personal loans with fair credit?

Interest rates for personal loans with fair credit can range from around 6% to 36%, depending on the lender and your specific credit profile.

How can I improve my credit score?

Improving your credit score involves paying bills on time, reducing your credit utilization, and avoiding new credit inquiries.

Are there any alternatives to the best personal loans for fair credit holders?

Alternatives include credit unions, secured loans, and peer-to-peer lending platforms.

Best personal loan

- Est. APR = 6.99%

- Loan type : Personal

- Loan amount: $1k - $50k

- Min credit score: 580

4.3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 6.99-35.99%

- Loan Amount = $100-$40K

- Min Credit Score = 300

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 9.99 - 39.99%

- Loan Amount = $1k - $50k

- Min Credit Score = 580

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Personal Loan for No Credit

- Est. APR 7.80% - 35.99%

- Loan amount $1k– $50k

- Min credit score 300

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99% to 35.99%

- Loan amount $500 to $5,000

- Min credit score = Any

3.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99%-35.99%

- Loan amount $1Kto $35K

- Min credit score = 580

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Flexible loan amounts

- 24/7 Support

- No prepayment fees

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Read More

Read More