Discover if you can use a personal loan for a car purchase. Learn about the benefits, drawbacks, and key considerations before applying.

These days, used cars cost more than $25,000, so you’ll need a personal loan for a car purchase before you can get into your next vehicle. Still, you may wonder if an auto loan or personal loan for a car purchase better suits you.

In general, vehicle loans are the best option. Still, we’ll help you determine whether a personal loan suits your specific scenario.

Can I use a personal loan for a car purchase?

A personal loan can be used to purchase a car if you meet the requirements.

One of the most tempting features of personal loans is their flexibility. With a few exceptions, they can be used for just about everything. For example, you may be unable to use your loan to invest, but purchasing a car should not be a concern.

However, due to higher interest rates and stricter credit standards, most borrowers do not use personal loans to finance vehicle purchases. In the third quarter of 2023, borrowers used only 1.3% of all personal loans to finance cars.

Related: How to Get an Auto Loan for a Car | Step-by-Step Guide

Personal loan vs. auto loan: What is the difference?

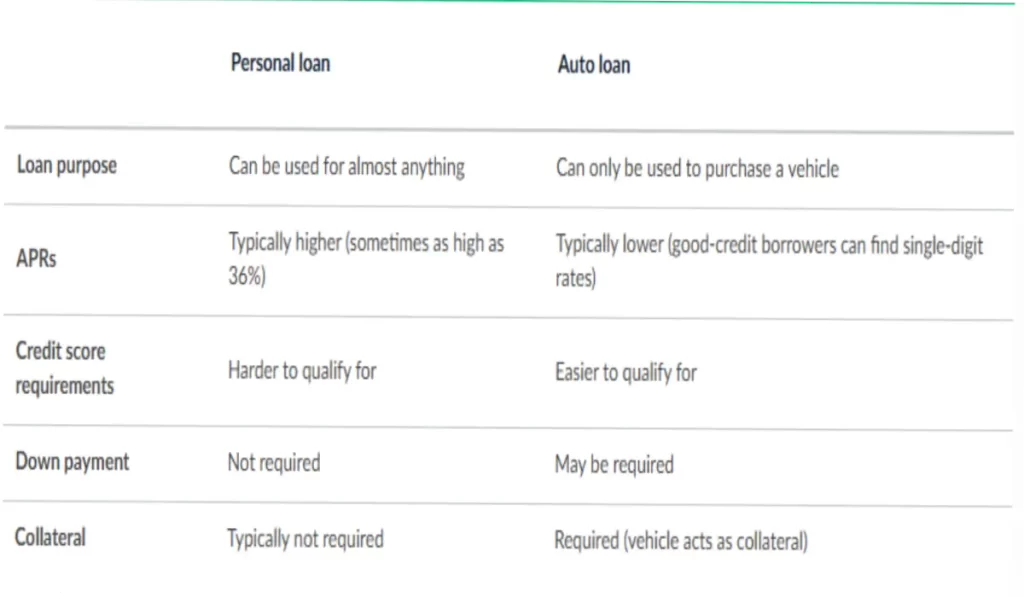

One of the most significant differences between personal and vehicle loans is the use of collateral.

Personal loans are unsecured loans, which means they do not require collateral. An auto loan uses the car as collateral, so if you don’t pay it back, your lender (a lienholder) can repossess it.

Auto loans are less hazardous for lenders because they can reclaim the amount owed through repossession. As a result, auto loan rates are often lower than those for personal loans.

The fundamental differences between personal loans and auto loans are outlined below:

Benefits of using a personal loan to buy a car

More flexibility

Auto loans are specific. They can only be used to purchase an automobile; you can only borrow up to the car’s purchase price. Unless you obtain a private party auto loan, they are often only available if you buy a car from a dealership.

In contrast, personal loans can be used for almost anything. For example, you can use a personal loan to purchase a vehicle from a dealership or a private seller.

You can even borrow more than your car’s purchase price, although this may cause problems. If you buy a car with a personal loan, borrow only what you need to avoid incurring extra debt.

No down payment is required.

Not all auto loans require a down payment, but many do. A hefty down payment may also reduce interest rates and help you avoid turning your auto loan upside down.

Personal loans do not require (or are not affected by) down deposits.

No collateral.

Personal loans are often not backed by collateral. This implies that you will not lose your car if you default on your loan.

Suppose you’re considering a personal loan because you’re concerned about repossession. In that case, you should reconsider your decision or choose a less expensive model. Repossession harms your credit and will make it more difficult to purchase another car in the future. Suppose you are genuinely concerned about your ability to repay the loan. In that case, there may be better options than incurring further debt.

Related: Whom to prefer for personal loans? Personalloans or Badcreditloans

Drawbacks of Using a Personal Loan for a Car Purchase

Higher interest rates.

Even for consumers with good credit, personal loans often have higher interest rates than auto loans. All else being equal, a personal loan for a car is frequently more expensive than an auto loan.

Higher monthly payments.

Personal loans typically have shorter repayment durations than automobile loans. In early 2023, the average used car loan lasted 67.6 months or over five and a half years. In contrast, most personal loans have periods ranging from 12 to 60 months.

Although a shorter loan term means you’ll pay less interest over the course of the loan, your monthly loan payments will increase. This is because you will have fewer months to stretch your payback over.

Borrowers with weak credit may need access to this option.

Personal loans have higher restrictions than auto loans because they do not use the vehicle as security. While a poor credit history will result in higher interest rates on any loan, you may be ineligible for a personal loan if your score is less than 660. Bad credit personal loans are accessible, but even if you qualify, you may expect interest rates of up to 36%.

When could buying a car with a personal loan make sense?

You are buying from a private vendor.

A personal loan could be the solution if you want to buy a car from a private seller but need the finances right now. Be sure you can keep to your loan’s payback plan. Suppose you do not repay an unsecured loan. In that case, you may face severe repercussions such as wage garnishment, lawsuits, and a destroyed credit score.

Some auto lenders offer private-party loans. Still, they are more challenging to find and usually have higher interest rates. Auto loans for buying a car from a private seller may also have mileage and loan amount restrictions, although personal loans do not.

Purchasing an unconventional automobile

Traditional auto loans are designed for new and used vehicles under ten years old. Depending on when you purchase a car, an auto loan may not be available. Although some lenders offer antique or exotic car finance, you may prefer a personal loan (if it is a better bargain).

If you don’t want to make a down payment

You must have good credit, or the dealership will conduct a promotion to make a down payment when purchasing a car with an auto loan. A personal loan allows you to drive off the lot without money.

How to use a personal loan for a car?

Shop for a new automobile.

Because personal loans are offered in lump sums, you must first choose how much you want to borrow before applying for one. If you borrow too little, you must pay the difference between your loan amount and the vehicle’s purchase price. If you borrow too much, you may be tempted to spend the excess money on unrelated purchases.

Knowing the car you want to buy will help determine how much money you should apply for. Remember that it may take a few days before your cash becomes available. You can inform the vendor beforehand to let them know you want to buy.

Compare lenders.

Taking out a personal loan is not a decision to be taken lightly, and choosing the first lender you find may result in a loan with unfavourable terms.

Personal loans are available from online lenders, traditional banks and credit unions. Take the time to look into a few options, paying careful attention to APRs, loan terms, origination costs, and prepayment penalties.

LendingTree’s personal loan marketplace allows you to compare rates from up to five lenders using a single form. Prequalification does not harm your credit and can help you locate the best loan conditions based on your financial position.

Apply

After you’ve chosen a lender, you’ll need to apply for your loan. This process varies, but you must supply basic biographical information and proof of income (such as pay stubs or a W-2).

Use borrowing funds to buy the car.

Once approved, you’ll receive your loan in one sum, usually by direct transfer. You can buy an automobile with cash. If you have spare funds, consider using them for car-related expenses such as title transfers, registration, or insurance. You might also utilize those funds to repay the loan, reducing your outstanding sum.

Begin repayment.

Your first loan payment is due around 30 days after disbursing. Always pay on time to avoid late penalties and marks on your credit. You could set up autopay for peace of mind (and possibly an APR decrease, depending on your lender).

Read More

Read More

One Response