Home equity loan and home equity lines of credit (HELOCs) allow homeowners to borrow against the value of their homes.

A home equity loan is a fixed-rate lump-sum loan that allows homeowners to borrow up to 85% of the value of their property and repay it in monthly installments. A home equity line of credit is a variable-rate second mortgage that uses the value of your property to provide a revolving line of credit.

Both methods use your property as collateral for payments, which means your lender can seize it if you are unable to repay the amount borrowed.

Are You Looking For A Home Loan?

- Est. APR = 9.95% - 14%

- Loan Amount = $150,000 - $3,000,000

- Minimum FICO Score: N/A

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- 24/7 Support

- Bridge & Rental Loans

- Equal Housing Opportunity

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Check Your Eligibility

- Equal Housing Opportunity

5

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

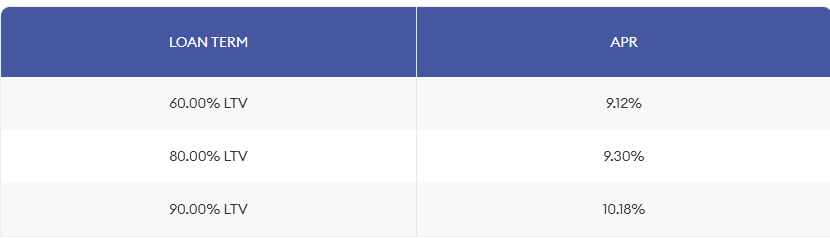

$100K HELOC Loan Rates

–Medium-Sized Projects

A $100,000 HELOC is ideal for larger renovation projects or other significant financial demands. Compare rates and terms to get the best option for your needs.

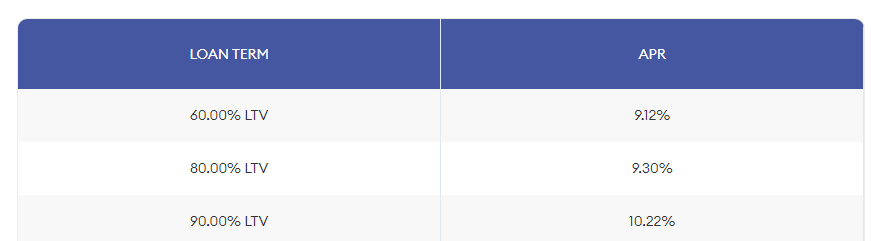

$250K HELOC Loan Rates

–Funds for Major Investments

A $250K HELOC with a variety of LTV options is ideal for larger projects or investments. Examine these rates to find the optimal balance between borrowing capacity and risk.

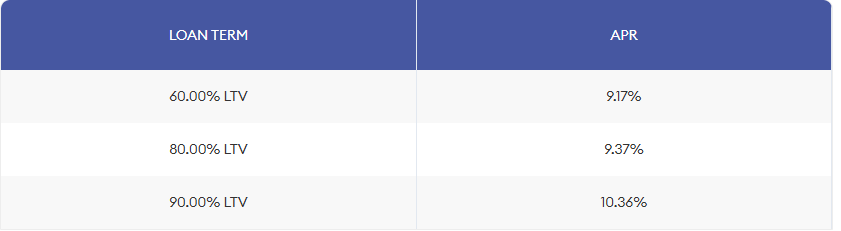

$500K HELOC Loan Rates

–Maximize Your Borrowing Power

Pros and Cons of a HELOC

Pros:

- Interest rates typically vary between 8% and 10%, which is lower than other loan kinds.

- HELOCs allow you to access your cash as needed, unlike a standard loan that is paid in a flat sum.

- You may be eligible to deduct interest payments from your taxes, depending on how you utilize your HELOC.

- You may have to pay many expenses, including appraisal, application, and closing fees.

Cons:

- Borrowing against your home’s equity might be problematic since you may owe more on your HELOC than your property is worth if its value lowers.

- Variable interest rates fluctuate according to the federal benchmark rate, potentially increasing monthly payments.

- Your home is used as collateral, putting it at danger of foreclosure if you default.

Related: Best Home Loan Providers 2024

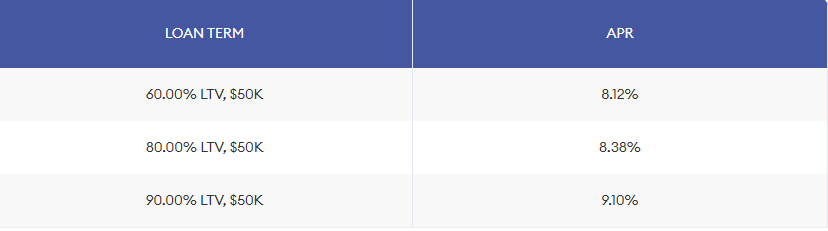

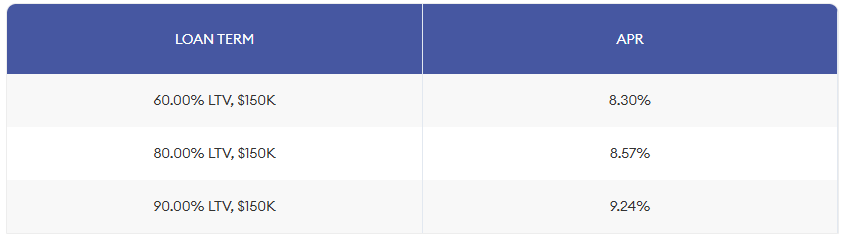

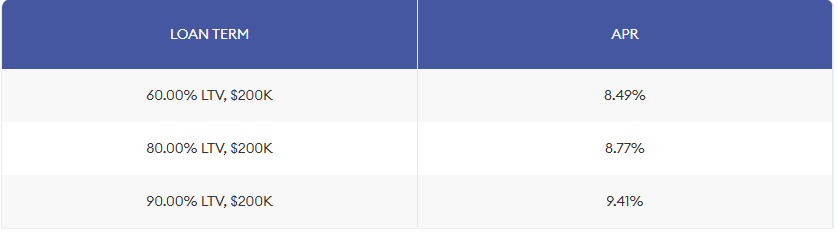

5-Year Home Equity Loan Rates (60 Months)

A 5-year term provides a shorter repayment time, but with often higher monthly payments. These products are appropriate for borrowers looking for a faster payoff.

10-Year Home Equity Loan Rates (120 Months)

With a 10-year term, borrowers can enjoy a balanced monthly payment while fast creating equity. 10-year home equity loans are best suited for medium-sized projects or financial needs.

15-Year Home Equity Loan Rates (180 Months)

A 15-year term has lower monthly payments than a shorter term, making it more affordable while still helping you achieve your financial goals.

Read More

Read More

One Response