Going to college or a trade school can be expensive. Luckily, there are student loans to help cover the costs. In the United States, the government offers two kinds of federal student loans to help students pay for school: Direct Subsidized and Unsubsidized Loans.

These loans can help you pay for tuition, books, housing, and other school-related expenses. But how do these loans work, and what’s the difference between the two? Let’s take a look!

- Est APR = 4.89-9.04%

- MIn Credit Score = 680

- No fees.

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

What Are Direct Subsidized and Unsubsidized Loans?

The U.S. Department of Education (ED) offers both direct subsidized and unsubsidized loans. These loans are part of the federal student loan program and can help students pay for higher education at a university, community college, or trade school. You might have heard of these loans being called Stafford Loans or Direct Stafford Loans, but the official names are Direct Subsidized and Unsubsidized Loans.

Direct Subsidized and Unsubsidized Loans

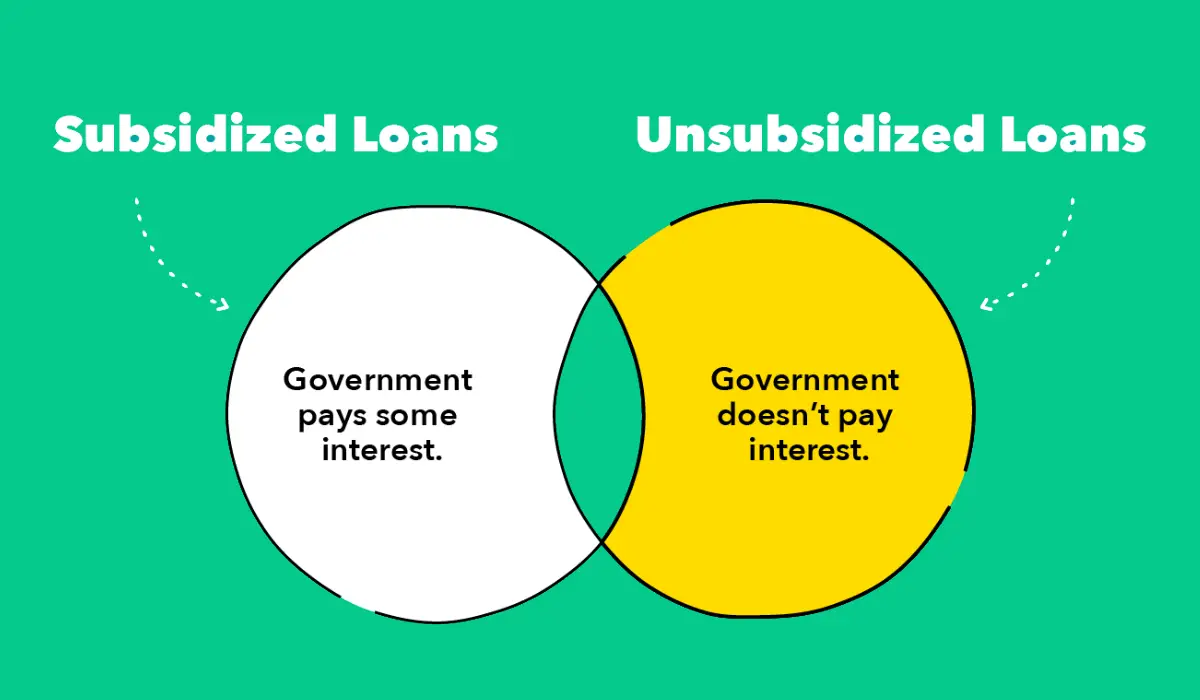

The main difference between Direct Subsidized and Unsubsidized Loans is who pays the interest on the loan while you’re in school and other times when you’re not making payments. With Direct Subsidized Loans, the U.S. Department of Education helps pay the interest on your loan during certain times. With Direct Unsubsidized Loans, you pay all the interest, even while in school.

Related: Does Financial Aid Cover Summer Classes? Complete Guide

What Is a Direct Subsidized Loan?

Direct Subsidized Loans are federal loans for students who demonstrate financial need. Financial need means that your family may not have enough money to pay for college on their own. With a Direct Subsidized Loan, the U.S. government helps you by paying the interest on your loan during specific periods.

Who Can Get a Direct Subsidized Loan?

Direct Subsidized Loans are available only to undergraduate students who can show that they have financial need. Undergraduate students are students who are working toward a two-year or four-year degree at a college or university.

How Much Can You Borrow with a Direct Subsidized Loan?

The amount of money you can borrow through a Direct Subsidized Loan depends on how much financial need you have. Your school will examine your family’s income and other financial information to decide how much you can borrow. However, there are limits on how much you can borrow each year, depending on your year in school.

Here’s how much you can borrow each year with a Direct Subsidized Loan:

- First-Year Undergraduate Students: Up to $3,500

- Second-Year Undergraduate Students: Up to $4,500

- Third-Year and Beyond Undergraduate Students: Up to $5,500

Who Pays the Interest on a Direct Subsidized Loan?

One of the best things about a Direct Subsidized Loan is that the U.S. Department of Education pays the interest on the loan during certain periods:

- While you are in school at least half-time,

- During your six-month grace period after you leave school, and

- During a period of deferment (when payments are paused).

This means you don’t have to worry about the interest piling up while you’re still in school or just starting out after graduation.

What Is a Direct Unsubsidized Loan?

Direct Unsubsidized Loans are another type of federal loan that helps students pay for college. Unlike Direct Subsidized Loans, Direct Unsubsidized Loans are available to all students—both undergraduates and graduates—regardless of financial need. This means that even if your family has a higher income, you can still qualify for a Direct Unsubsidized Loan.

Who Can Get a Direct Unsubsidized Loan?

Direct Unsubsidized Loans are available to both undergraduate and graduate students. You do not need to show that you have financial need in order to qualify for this loan.

How Much Can You Borrow with a Direct Unsubsidized Loan?

Just like with Direct Subsidized Loans, the amount of money you can borrow with a Direct Unsubsidized Loan depends on your school’s determination. They’ll look at the cost of attendance (how much it costs to go to school) and any other financial aid you receive to decide how much you can borrow. There are limits on how much you can borrow each year and in total during your college career.

Here’s how much you can borrow with a Direct Unsubsidized Loan:

- First-Year Undergraduate Students: Up to $9,500 (no more than $3,500 in subsidized loans)

- Second-Year Undergraduate Students: Up to $10,500 (no more than $4,500 in subsidized loans)

- Third-Year and Beyond Undergraduate Students: Up to $12,500 (no more than $5,500 in subsidized loans)

- Graduate or Professional Students: Up to $20,500 per year (unsubsidized only)

Who Pays the Interest on a Direct Unsubsidized Loan?

With a Direct Unsubsidized Loan, you are responsible for paying the interest during all periods. This includes while you are in school, during any grace period, and during any deferment or forbearance (when payments are temporarily paused). If you choose not to pay the interest while you’re in school, the interest will accumulate and be added to the principal amount of your loan. This is called capitalization, and it means you’ll end up owing more money in the long run.

- Est APR = 4.89-9.04%

- MIn Credit Score = 680

- No fees.

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

What Are the Loan Limits for Direct Subsidized and Unsubsidized Loans?

There are limits on how much you can borrow with both types of loans. These limits depend on your year in school and whether you are a dependent or independent student. Independent students can borrow more money than dependent students because their parents are not expected to help pay for their education.

Here’s a chart showing the annual loan limits for dependent and independent students:

| Year in School | Dependent Students | Independent Students |

| First-Year Undergraduate | $5,500 (no more than $3,500 in subsidized loans) | $9,500 (no more than $3,500 in subsidized loans) |

| Second-Year Undergraduate | $6,500 (no more than $4,500 in subsidized loans) | $10,500 (no more than $4,500 in subsidized loans) |

| Third-Year and Beyond Undergraduate | $7,500 (no more than $5,500 in subsidized loans) | $12,500 (no more than $5,500 in subsidized loans) |

| Graduate or Professional Students | Not Applicable | $20,500 (unsubsidized only) |

There are also aggregate loan limits, which is the total amount you can borrow over your entire college career:

- Dependent Undergraduate Students: Up to $31,000 (no more than $23,000 in subsidized loans)

- Independent Undergraduate Students: Up to $57,500 (no more than $23,000 in subsidized loans)

- Graduate or Professional Students: Up to $138,500 (no more than $65,500 in subsidized loans)

Graduate and professional students enrolled in certain health profession programs may be able to borrow more than these limits.

Related: Private Student Loans Of 2024

Who Is Eligible for These Loans?

To qualify for either Direct Subsidized or Direct Unsubsidized Loans, you must:

- Be enrolled at least half-time in a school that participates in the Direct Loan Program,

- Be enrolled in a program that leads to a degree or certificate,

- Fill out the Free Application for Federal Student Aid (FAFSA®) form.

Direct Subsidized Loans are only available to undergraduate students with financial need, while Direct Unsubsidized Loans are available to both undergraduate and graduate students.

How to Apply for a Direct Loan

To apply for a Direct Loan, you need to complete the FAFSA® form. This form helps your school determine how much financial aid you are eligible to receive. After submitting your FAFSA, your school will let you know how much money you can borrow through Direct Subsidized or Unsubsidized Loans. The loan will be part of your financial aid package.

What Are the Interest Rates and Fees?

Interest rates for Direct Subsidized and Unsubsidized Loans vary depending on when the loan is disbursed and the type of loan. You can check the current interest rates by visiting the Federal Student Aid website or asking your school’s financial aid office.

Additionally, there are loan fees that you must pay when you borrow the loan. These fees are a percentage of the loan amount and are deducted from the money you receive.

How to Accept Your Loan

Once your school offers you a Direct Loan as part of your financial aid package, you will need to accept the loan. If this is your first time receiving a Direct Loan, you’ll need to complete entrance counseling. This helps ensure you understand your responsibilities and the terms of your loan. You’ll also need to sign a Master Promissory Note (MPN), which is a legal document that says you agree to repay your loan.

Loan Repayment Options

Repaying your loan is important, but you usually won’t have to start making payments right away. With both Direct Subsidized and Unsubsidized Loans, you have a six-month grace period after you leave school before you need to begin repayment.

There are several repayment plans to choose from, depending on your financial situation. Some repayment plans allow you to make smaller payments at first and larger payments later. Others are based on how much money you earn after graduation.

Here are some common repayment plans:

- Standard Repayment Plan: Fixed monthly payments over 10 years.

- Graduated Repayment Plan: Lower payments at first, then gradually increasing payments over time.

- Income-Driven Repayment Plans: Monthly payments are based on your income and family size.

Direct Subsidized and Unsubsidized Loans are important tools for helping students pay for college. While both types of loans can provide the money you need, they have key differences. Subsidized loans offer the benefit of interest being paid by the government while you’re in school, while unsubsidized loans do not. It’s essential to understand how each loan works and how much you can borrow to make the best financial decision for your education.

By knowing how these loans work and carefully planning for repayment, you can reduce your financial stress and focus on achieving your educational goals.

What Happens If You Don’t Repay Your Loans?

If you don’t repay your loans on time, your loan could go into default. Defaulting on your loan can have serious consequences, such as:

- Damage to your credit score: A poor credit score can make it difficult to get approved for credit cards, car loans, or even renting an apartment in the future.

- Collection fees: You may be charged additional fees if your loan is sent to a collection agency.

- Wage garnishment: In extreme cases, the government can take money directly from your paycheck or withhold your tax refunds to collect on the unpaid loan.

- Loss of eligibility for future financial aid: If you default on a federal loan, you might lose your ability to receive other financial aid in the future.

It’s important to stay in contact with your loan servicer if you’re having trouble making payments. You may be eligible for alternative repayment plans or deferment or forbearance, which can temporarily stop or lower your payments.

How to Make a Smart Borrowing Decision

Before taking out any student loan, it’s crucial to understand exactly how much you need and what your repayment will look like after graduation. Here are some tips to help you make a smart borrowing decision:

- Borrow only what you need: It might be tempting to borrow the maximum amount offered, but remember that you’ll have to pay it back with interest.

- Understand your future earnings: Research the average salary for graduates in your field. This can help you estimate how much you’ll be able to afford in student loan payments.

- Consider alternative funding sources: Look into scholarships, grants, work-study programs, or part-time jobs to help reduce how much you need to borrow.

- Create a budget: Having a clear budget during school can help you manage your expenses and avoid taking on more debt than necessary.

How Can You Keep Track of Your Loans?

The federal government provides a tool called the National Student Loan Data System (NSLDS). By logging into this system, you can see all the federal student loans you’ve borrowed, how much you owe, and your loan servicer’s information. Keeping track of your loans will help you stay organized and on top of your repayments after you leave school.

- Est APR = 4.89-9.04%

- MIn Credit Score = 680

- No fees.

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Also Read: Your Student Loan Payments Can Now Help You Save For Retirement

Frequently Asked Questions

What is the main difference between Direct Subsidized and Unsubsidized Loans?

The main difference is that with Direct Subsidized Loans, the government pays the interest while you’re in school, during your grace period, and during deferment. With Direct Unsubsidized Loans, you are responsible for all the interest.

Do I need to demonstrate financial need to get a Direct Unsubsidized Loan?

No, financial need is not required for Direct Unsubsidized Loans. They are available to all students, regardless of financial need.

How long do I have to repay my loan?

The repayment period for federal student loans is typically 10 to 25 years, depending on the repayment plan you choose.

What happens if I don’t make payments on my loan?

If you don’t make payments on your loan, your loan could go into default, which can harm your credit score and lead to other financial issues.

Can I pay off my loan early?

Yes, you can pay off your loan early without any penalties. This can help you save money on interest over time.

Read More

Read More