An investment property loan is a mortgage used to purchase an income-producing property. This includes purchasing real estate to rent or renovate it before selling it for a profit—a practice known as “house flipping.”

Short-term hard money investor loans are another option for purchasing homes that you want to fix up and sell immediately.

An actual investment property loan is predicated on the idea that you will rent out the home to tenants to generate rental income rather than residing in it yourself. If you want to reside in one of the units, you can buy multifamily investment properties using typical loan programs.

Business Loans

01

Business Loans

02

Business Loans

03

Business Loans

04

5

Average Review

Business Loans

- Certified pre-approval Process

- Online Application Available 24/7

5

Average Review

Business Loans

- Automatically save and invest with Round-Ups® feature

- Expert-built portfolios, suggested for you

- Plus more ways to save, invest and learn

5

Average Review

Business Loans

- $1B+ in funds transferred

- Best time to invest

- 4.9 | Excellent 2000+ Reviews TrustPilot

5

Average Review

Business Loans

- Individual investors

- Workplace plan savers

- Plan sponsors

- Financial professionals

What is an Investment Property?

An investment property is a real estate that you purchase to generate revenue. “Investment property” can refer to anything from a one-unit condominium to a high-rise commercial skyscraper in a metropolis. However, for the sake of this piece, we’ll focus on residential real estate loans, which only finance homes with one to four units. Residential investment property types include:

- Condominiums

- Manufactured homes

- Multifamily homes

- Cooperatives

Types of Investment Property Loan

When it comes to buying investment properties, you have several options.

- Conventional loans: The conventional loan program is the only standard loan program that permits you to purchase an investment property with no restrictions. Unlike government-backed mortgages, you are not required to live in the home to qualify.

- FHA loans: To qualify, you can buy a two- to four-unit property with an FHA loan — a mortgage insured by the Federal Housing Administration (FHA) — and collect rent on the other units as long as you reside in one of them for at least a year.

- VA joint loans: This VA multifamily lending program is limited to qualifying military borrowers. It allows people to purchase a property with up to seven units, as long as one of them is their primary residence. The United States Department of Veterans Affairs (VA) insures these loans with no down payment.

- Non-QM loans: Borrowers who do not qualify for any programs listed above may be eligible for a nonqualified mortgage (non-QM) loan based solely on the rental income earned on the home they purchase. The down payment and interest rates are higher than for traditional lending schemes.

- Owner financing. Sometimes, sellers will act as lenders, providing temporary funding so you can buy the home in exchange for a substantial nonrefundable down payment. Some owner financing arrangements feature a balloon payment, which means you must pay off the whole loan debt within a specific time frame, or the owner will take back the property.

- Home equity loans. If you already own a property with significant equity, you can borrow against it through a home equity loan or line of credit (HELOC). With home equity loans and HELOCs, you can borrow some of your equity while keeping your current mortgage debt in place. A home equity loan is paid in one flat sum.

- Cash-out refinancing. A cash-out refinance occurs when you take out a mortgage for more than you owe and keep the difference in cash, which you can use to buy an investment property.

- Hard money loans. These loans are more popular among flipping investors – hard money investors will offer you money if they know you’ll pay it back promptly. However, you will typically be required to make at least a 25% down payment and will be charged hefty interest rates and upfront points. Prepayment penalties are not uncommon.

How to Refinance Investment Property Loan?

Obtaining an investment loan includes a few more stages beyond the mortgage process.

Search for an investment property mortgage lender.

Most lenders offer some form of investment property loan option; however, rates can vary greatly among organizations. Non-QM loans are not available from all lenders, so you may need to make further calls if you require one. Hard money lenders are typically private individuals or partnerships; contact your real estate agent or other real estate investors for advice.

Fill out the loan application.

If you’re applying for a typical loan program, such as a conventional, FHA, or VA loan, the process is the same as with any other loan. Non-QM and hard money lenders, on the other hand, may use their own method or application system.

Provide more asset documentation.

Have at least two months’ bank statements and any current leases or rental information for the property you are buying. Lenders often allow you to apply a portion of your retirement or 401(k) vesting to your reserve requirement, so keep a current statement ready.

Pay for an investment appraisal.

The home appraisal process necessitates an additional report outlining the average rent received on comparable residences in the neighbourhood. In some situations, this report’s rental revenue may help you qualify for the loan.

Please review your closing disclosure.

After your loan criteria are met and the appraisal is completed, the lender will send you a closing disclosure three working days before the closing date. Please review it to ensure that all of the figures are as expected. If you’re getting a hard money loan, understand any prepayment penalties or “guaranteed interest” clauses. Typically, hard money lenders seek to earn a certain amount of interest regardless of how quickly you repay the loan.

Collect your cash and close.

Your closing money will be sent by wire or delivered as a cashier’s check. Once the mortgage closing documentation is signed, your loan funds are transferred, and the property is recorded in your name.

Related: Current Mortgage Refinance Rates July 2024 – Latest Rates

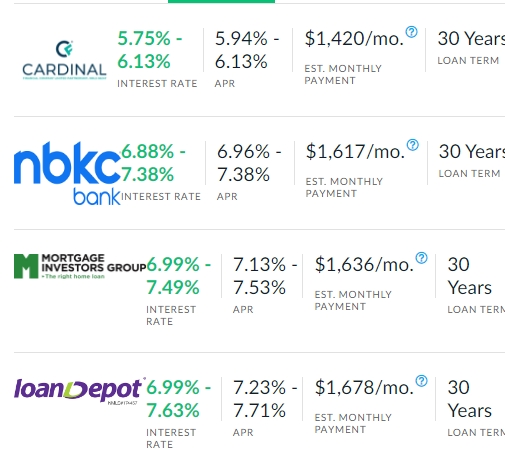

Investment property mortgage rates

Lenders must raise investment property mortgage rates to account for the increased risk that the loans would default. In general, investment property rates will be 0.5 to 0.875 percentage points more than those for primary residences.

You will pay lower investment property fees if you have at least 30% equity in your rental home. This lowers the cost of an investment property rate by $1,500, potentially leading to a better rate or reduced charges.

Your credit score and down payment significantly impact the rate you are offered. Applicants with weaker credit scores may have to pay mortgage points to secure an investment property loan.

Requirements to Get an Investment Property Loan

Lenders see investment property loans as riskier than financing on a primary house. The qualifying conditions demand that you demonstrate more financial stability. Requirements for investment property loans include:

- Higher down payments. If you plan on living in one of the units, you can buy a multifamily house with an FHA or VA loan for only 3.5%. Although conventional rules allow for down payments as low as 15% on rental homes, most lenders require at least 20%. The money must be entirely yours; gifts are prohibited when purchasing a rental home under traditional criteria. However, down payment gifts are allowed for VA and FHA multifamily house acquisitions.

- Reserves. More frequently known as “mortgage reserves,” the monthly payments the lender likes to see in the bank.

- Proof of rental revenue. The lender may request documents of current leases, a rent roll history, and tax returns that prove rental revenue. In most situations, the appraisal will also involve an examination to confirm the rental rates of similar homes in the neighbourhood.

- Qualifying based on rental income. Lenders may allow you to qualify by including the actual or expected rental income from the home you’re buying. For example, when determining your qualifying income, FHA and VA multifamily loan criteria will consider rent payments from units you do not live in.

- History of property management. Some financing programs ask you to document or justify your previous experience renting property. Others may want tax documents indicating that you have previously handled rental properties.

- Higher credit score requirements. A minimum credit score of 640 is required for an investment property mortgage, although this may increase to 700 or more if you purchase a multifamily residence.

Frequently Asked Questions

How can I get the best investment property mortgage rate?

To get the best investment property rates on a conventional mortgage in 2024, you’ll need better credit, fewer debt, and a larger down payment.

Raise your credit score: After August 1, 2024, you must have a credit score of at least 780 to qualify for the lowest rates. That’s a significant increase above 740, the standard for the best rates for several years.

Lower your DTI ratio. In most situations, your DTI ratio, which compares your monthly debt payments to your monthly gross income, should be at most 43%. This is even more essential after the Fannie Mae reforms go into force. A DTI ratio exceeding 40% will result in higher interest rates or closing costs. (This change takes effect August 31, 2024.)

How many investment properties can I own?

As many properties as you can afford to own are yours. Nevertheless, with traditional mortgage lending, the number of properties you can finance with a mortgage is limited to ten.

Can I get an investment property loan in an LLC?

No, you have to take out the loan in your name. However, after you buy the property, you can transfer it into an LLC according to Fannie Mae’s requirements.

Can I get a gift for cash reserves?

Not on a rental property. Stocks, vested 401(k) accounts, and retirement funds are examples of asset funds that you will need to employ.