Upstart is an artificial intelligence (AI)-powered loan platform that links borrowers to affiliated lenders. The platform employs over 1,500 unconventional criteria, such as college education, to boost loan access, making it a good choice for consumers with fair credit. Furthermore, artificial intelligence enables Upstart to approve the vast majority of loans extremely instantaneously. Personal loans ranging from $1,000 to $50,000 are available for durations of three or five years.

Best personal loan

- Est. APR = 6.99%

- Loan type : Personal

- Loan amount: $1k - $50k

- Min credit score: 580

4.3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 6.99-35.99%

- Loan Amount = $100-$40K

- Min Credit Score = 300

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 9.99 - 39.99%

- Loan Amount = $1k - $50k

- Min Credit Score = 580

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Personal Loan for No Credit

- Est. APR 7.80% - 35.99%

- Loan amount $1k– $50k

- Min credit score 300

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99% to 35.99%

- Loan amount $500 to $5,000

- Min credit score = Any

3.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99%-35.99%

- Loan amount $1Kto $35K

- Min credit score = 580

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Flexible loan amounts

- 24/7 Support

- No prepayment fees

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Who Is Upstart Best for?

Upstart offers personal loans to consumers with fair credit (scores of at least 600) by looking beyond credit history and taking into account a variety of non-traditional credit indicators. This makes the platform an attractive choice for candidates who require immediate access to funds but may not otherwise be authorized for a loan.

Upstart also offers $1,000 minimum loans in all states except Massachusetts ($7,000), Ohio ($6,000), New Mexico ($5,100), and Georgia, ensuring that customers don’t borrow more than they need.

However, Upstart’s expanded accessibility comes with a cost. Annual percentage rates (APRs) are high, and borrowers can only borrow for three or five years, which is far shorter and less flexible than with other online lenders. Upstart may also charge borrowers fees for loan origination, late or unsuccessful payments, and paper copies. Still, Upstart is a viable choice for individuals who do not have a credit score that qualifies them for lower-cost loans.

Related: Upgrade Vs. Upstart: Which Personal Loan Provider Is Right For You?

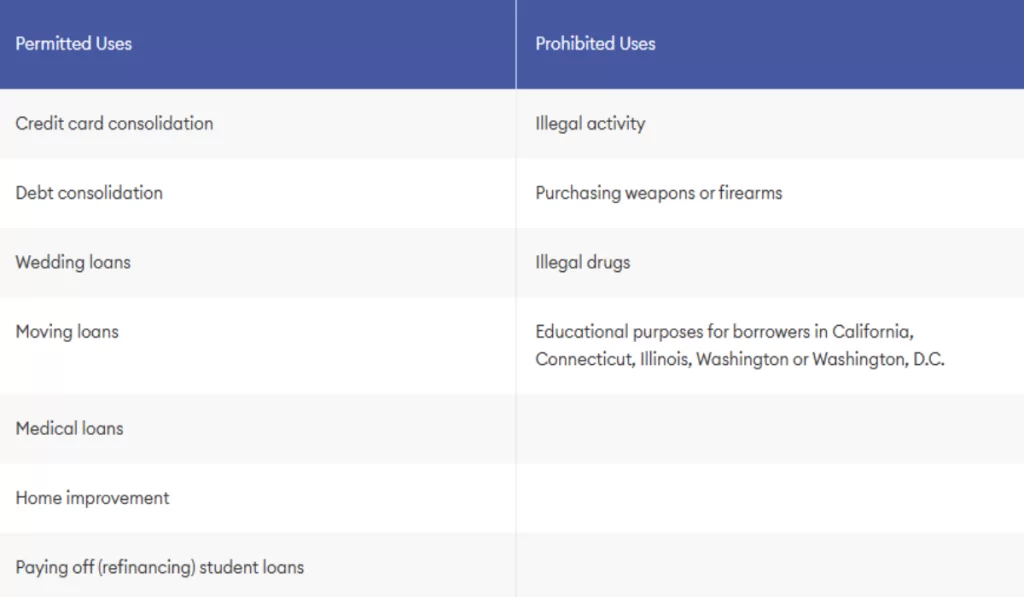

Upstart Loan Purposes

Upstart Personal Loan Details

Loan Amounts and Terms

Loan amounts: Upstart offers fixed-rate personal loans ranging from $1,000 to $50,000. There are state-specific minimums in Massachusetts ($7,000), Ohio ($6,000), New Mexico ($5,100), and Georgia ($3,100).

Loan terms: Borrowers can take out personal loans for three or five years—36 or 60 months, respectively.

Loan Costs

APR: Rates range from 7.8% to 35.99%. Upstart does not offering autopay discounts like other suppliers.

Fees for originating transactions: Upstart charges from 0% to 8%. This is a one-time fee levied from loan proceeds before they are distributed to the borrower.

Late fees: If a borrower fails to make the full monthly payment within 10 calendar days of the due date, Upstart will assess a late fee equivalent to 5% of the past due amount or $15, whichever is larger.

Prepayment penalties apply: Borrowers who want to pay off their loan early do not face prepayment penalties with Upstart.

Unsuccessful payment fee: There is a $15 fee per occurrence when bank transfers (ACH) or cheques are returned or fail owing to insufficient funds—or for any other reason.

Paper copy fees: Borrowers who request physical copies of documents and revoke eSign consent are charged a one-time cost of $10 by Upstart.

Perks and Features

Hardship program: Borrowers can petition to temporarily stop loan payments if they face economic difficulty, such as job loss. Keep in mind, however, that interest continues to accumulate during this time.

Related: Top Personal Loan Providers in 2024

How to Qualify for a Startup Personal Loan

Personal loan applications are granted or denied depending on a variety of criteria. Underwriting standards vary per lender, but they often include information from an applicant’s credit profile as well as other elements that reflect the ability to repay the loan, such as income. Meeting the standards listed below does not guarantee approval, but it can help you determine whether a personal loan is a good fit for you.

Credit Score Requirements

Borrowers must have a FICO or Vantage score of at least 600 to qualify for a personal loan. Upstart, on the other hand, takes into account unconventional criteria such as college education, career history, and residency. Even candidates without sufficient credit history to obtain a FICO score may be accepted.

In addition to the credit score, Upstart’s AI platform considers:

- A borrower’s debt-to-income (DTI) ratio

- Does the borrower have any bankruptcies or unpaid accounts?

- Number of credit report queries in the last six months, excluding questions connected to school loans, vehicle loans, or mortgages (must be less than six)

Income requirements

Upstart borrowers must have a full-time employment or an offer starting in six months, a regular part-time work, or another source of consistent income, with a minimum annual income of $12,000. Furthermore, applicants must have no recent bankruptcy or outstanding delinquencies.

Co-signers and applicants

Upstart does not allow potential borrowers to apply for a personal loan with a cosigner. Likewise, co-applicants are not authorized; loan applicants are judged only on their own merits.

Upstart Customer Reviews

Upstart has received 4.9 stars on TrustPilot and is usually well-reviewed across a variety of consumer channels. Positive feedback focuses primarily on the application process and convenience of Upstart’s credit card consolidation loans. Negative reviews typically focus on issues with bill payments, customer service responses, and Covid-19-related assistance.

Best personal loan

- Est. APR = 6.99%

- Loan type : Personal

- Loan amount: $1k - $50k

- Min credit score: 580

4.3

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 6.99-35.99%

- Loan Amount = $100-$40K

- Min Credit Score = 300

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best personal loan for bad credit

- Est. APR = 9.99 - 39.99%

- Loan Amount = $1k - $50k

- Min Credit Score = 580

4.8

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Best Personal Loan for No Credit

- Est. APR 7.80% - 35.99%

- Loan amount $1k– $50k

- Min credit score 300

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99% to 35.99%

- Loan amount $500 to $5,000

- Min credit score = Any

3.7

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Est. APR 5.99%-35.99%

- Loan amount $1Kto $35K

- Min credit score = 580

4.4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

- Flexible loan amounts

- 24/7 Support

- No prepayment fees

4

editorial team. We score based on factors

that are helpful for consumers, such as

how it affects credit scores, the rates and

fees charged, the customer experience,

and responsible lending practices.

Read More

Read More

One Response